Several of the single-stock, covered call ETFs launched this year have become household names, but broader strategies have also garnered a lot of interest. Among the more interesting launches recently is the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW), notes Michael Gayed, editor of The Lead-Lag Report.

Even though Treasuries have gotten bounced around quite a bit over the past few years, they remain one of the best long-term risk-off assets. When the market makes a true flight to safety shift, long-term Treasuries could be one of the best risk balancers and upside opportunities available.

(Editor’s Note: Michael Gayed is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. Click HERE to register)

Covered call strategies have been in demand. Fund issuers used to almost exclusively center their covered call strategies around equities. iShares changed the game. TLTW has since been able to deliver huge yields, but total returns have been mixed. If market volatility picks up and yields start to head lower again, there could be a big return opportunity here.

TLTW seeks to track the investment results of an index that reflects a strategy of holding the iShares 20+ Year Treasury Bond ETF (TLT) while writing (selling) one-month covered call options to generate income. The index aims to use options that are approximately 2% out-of-the-money, limiting income potential somewhat, but providing the opportunity for some capital growth along the way.

The primary gripe about funds using covered call strategies is that a lot of them use options that are roughly at-the-money. Those options often come with higher premiums, but it also means that capital appreciation is essentially fully capped. I prefer the 2% out-of-the-money strategy used by TLTW because it strikes a better balance, if only a modest one.

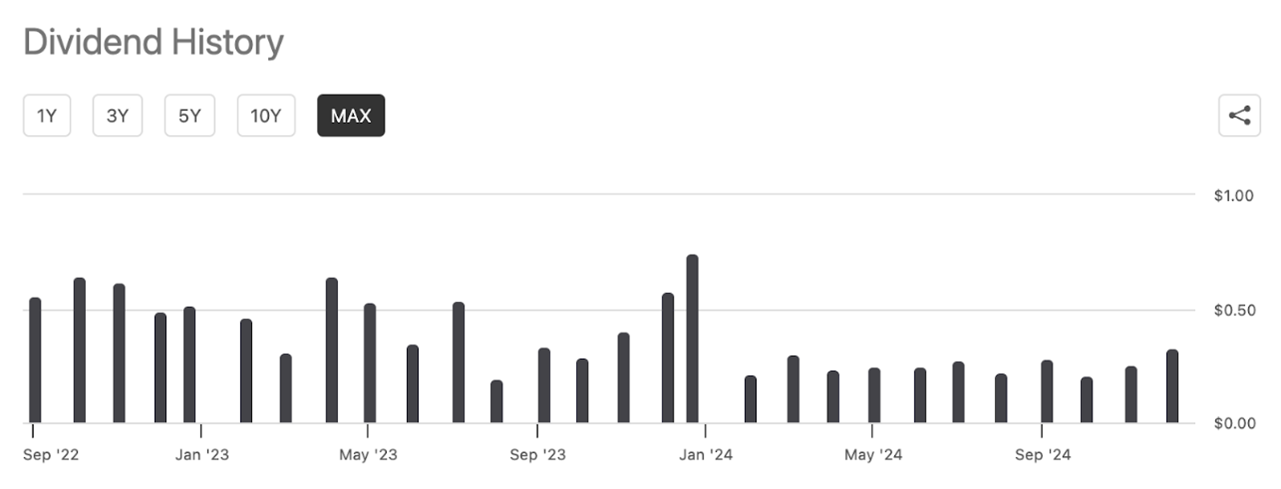

TLTW was launched in August 2022. Since its inception, the fund has returned a total of -9%, which translates to around -4% annually. Obviously, this fund launched at a bad time.

But monthly distributions have become relatively steady over the last year. Bond market volatility has been slowly coming down, although the possibility of a re-acceleration due to rising inflation is very much in play. Still, yields on TLTW should be well into the double digits for the foreseeable future.

Conclusion: The difference between a 14%-15% yield on TLTW and a 4% yield on TLT is substantial. That gives TLTW a lot of wiggle room to experience some share price contraction, yet still outperform the underlying fund. I like TLTW as a high yield opportunity.

Recommended Action: Buy TLTW.