The “Trump Trade” from a 30,000-foot view appears to be over for the time being, but some of the sectors and asset classes likely to be direct policy beneficiaries are still doing well. Meanwhile, the yen is still the currency to watch, notes Michael Gayed, editor of The Lead-Lag Report.

Financials, energy, and crypto have been the biggest recent winners, which means that value has also been making a comeback. Even though defensive equities haven’t been signaling a notable risk-off sentiment building, utilities and gold have been staging comebacks in recent days, too. All of this is consistent with the idea that investors are turning their attention to long-term implications.

(Editor’s Note: Michael Gayed is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. Click HERE to register)

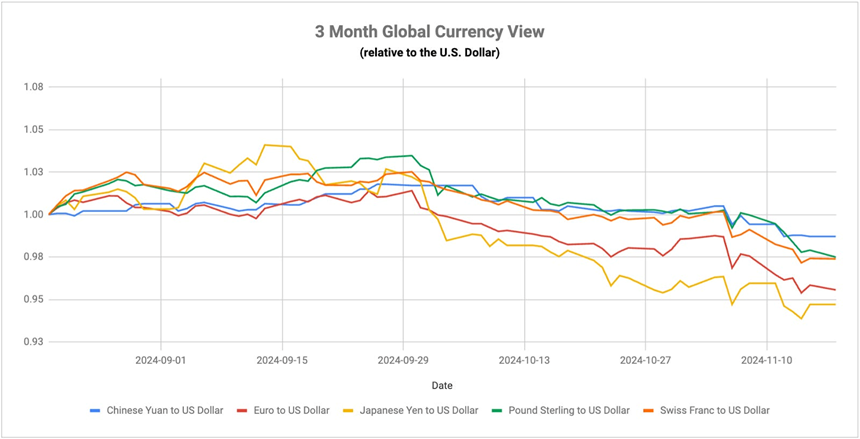

In other news, dollar dominance continues in the forex market and is being boosted by a combination of factors. Treasury yields on the long end of the curve have risen to the 4.5% range and haven’t shown an inclination to move lower (though the dust-up in the Russia/Ukraine conflict did send longer-term yields modestly lower in the short-term).

The odds of another rate cut by the Fed in December appear to be slowly diminishing, too. That has improved interest rate differentials against other currencies, especially against the yen, where the Bank of Japan may choose to forgo its own interest rate move next month.

Volatility is starting to pick up as the BOJ looks closer to losing its handle on managing inflation and growth concurrently. It was a rate cut that really triggered the reverse yen carry trade last time around. If another hike gets delayed, it may also delay the chances of a repeat in the near-term.

On the other hand, if the market starts discounting a December rate hike as a possibility and the BOJ does end up pulling the trigger, we could see a volatile reaction that sees the yen soaring.