Contact Us: Dana Samuelson, President

Request Information

About American Gold Exchange, Inc.

Founded in 1998, American Gold Exchange is a leading national precious metals and rare coin company specializing in dealer-to-dealer trading and direct sales to the public. AGE draws upon a huge supplier network in the US and Europe, enabling us reliably to offer an almost limitless inventory of highest quality gold, silver, platinum, and palladium coins and bars at extremely low prices. Our mission is to help you to build and manage a profitable, private, enjoyable hard asset portfolio of any size. Customer service is our highest priority and value is our watchword. Recommended by Stansberry Research, Mary Anne and Pamela Aden of the Aden Forecast, Robert Kiyosaki, Brien Lundin, and many others.

OnDemand Videos

American Gold Exchange, Inc.'s Articles

American Gold Exchange, Inc.'s Videos

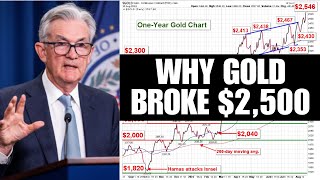

With 44 years of gold market experience, American Gold Exchange President Dana Samuelson has pretty much seen it all regarding gold, until now. With gold hitting new, record highs in April Dana will explain what new factors have driven gold to its recent peak, and why higher highs are still likely. The fundamentals driving the god price are entrenched and rock solid and now they are being turbo charged by recent, new external factors. Dana will down on both the old and the new gold price drivers in this mid-year gold market update.

Gold market expert Dana Samuelson explains the facts and benefits of having a small portion of your net assets in gold for diversification, portfolio enhancement, gold’s inverse correlation to traditional paper assets, and other factors unique to the world’s oldest and most trusted form of money.