About Mike

Michael Turner, president and chief portfolio manager of Turner Capital Investments, LLC, has a strong financial, mathematical, computer science, and engineering background. He takes a disciplined, rules-based approach to trading through the use of his unique market-directional investments.

Mike's Articles

Mike's Videos

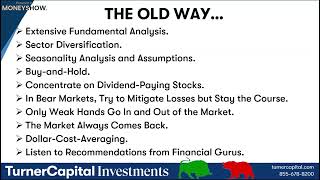

In this 30-minute session, discover how to turn both bull and bear markets into opportunities for massive growth, without shorting. You’ll learn a proven methodology that has been tested to grow your portfolio at up to 10 times the return of the S&P 500 over a 25-year test period. Learn to ignore the noise by mastering a versatile trading strategy based on rules and discipline. You’ll also learn precise, actionable insights on what to buy, when to buy, and when to secure profits, empowering you to navigate any market condition confidently. Get ready to transform market dips into wealth-building opportunities and outperform traditional investing with a game-changing system designed for consistent capital growth.

So, just what is a common-sense trading strategy? It does the following: your money grows in up-markets, down markets, and flat markets. Your money is liquid all the time. Get in or out anytime you want. And on top of all of that, you get to choose whether you want a 1x or 2x or 3x growth rate. Join Mike Turner, a world-class thought leader for money management, as he walks you through one of the most amazing common-sense and incredibly successful portfolio management processes you have ever seen and how easy it is to put this process to work for you today! No more guessing about what the market is going to do tomorrow or next week or for the rest of the year You’ll actually look forward to bear markets instead of being scared to death of them. Finally… A trading strategy that works in all markets!

So, just what is a common-sense trading strategy? It does the following: your money grows in up-markets, down markets, and flat markets. Your money is liquid all the time. Get in or out anytime you want. And on top of all of that, you get to choose whether you want a 1x or 2x or 3x growth rate. Join Mike Turner, a world-class thought leader for money management, as he walks you through one of the most amazing common-sense and incredibly successful portfolio management processes you have ever seen and how easy it is to put this process to work for you today! No more guessing about what the market is going to do tomorrow or next week or for the rest of the year You’ll actually look forward to bear markets instead of being scared to death of them. Finally… A trading strategy that works in all markets!

From time to time, throughout history, a breakthrough occurs. Sometimes that breakthrough is in medicine; sometimes in science; sometimes in technology; and, on rare occasions a breakthrough occurs in the world of finance. About two years ago, we discovered an amazing fact in the world of buying and selling equities on the public market. This fact recognizes that current technology permits us to make trading decisions based 100% on observing the current Market Consensus which tells us what the market is thinking and where the market is headed. Market Consensus processes vast amounts of information—such as economic data, company performance, geopolitical events, and investor sentiment—resulting in stock prices that reflect the collective assessment of all available information at any given time.

Our breakthrough technology is encapsulated in how to capitalize on this collective wisdom of the market. I will show you how this breakthrough works and how it totally revolutionizes the timing of when to be in the market and how to be in or out of the market, with no guessing; no hoping; no buy-and-hold; no magic; no tricks. This breakthrough is truly a paradigm shift in how to make money in the stock market. This is a must-attend session that just might change your financial life for the better...in a big way!

Mike's Books

10: The Essential Rules for Beating the Market