Follow

About Thomas

Thomas Lee is a co-founder, managing partner, and the head of research at Fundstrat Global Advisors and FSInsight.com. He is an accomplished Wall Street strategist with over 25 years of experience in equity research and has been top ranked by Institutional Investor every year since 1998. Prior to co-founding Fundstrat, he served most recently as JP Morgan's chief equity strategist from 2007 to 2014, and previously, as managing director at Salomon Smith Barney. His areas of expertise include market strategy, small/mid-cap strategy, and telecom services. Mr. Lee received his BSE from the Wharton School at the University of Pennsylvania with concentrations in finance and accounting. He is a CFA charterholder and is an active member of NYSSA and the NY Economic Club.

Thomas's Videos

2025 got off to a rocky start after a rollicking 2024. But what does the second half hold for markets – and your portfolio? Tom provides his outlook for the rest of the year, including his expectations for the stock market, leading sectors, and Bitcoin and other cryptocurrencies.

Equity markets are on track to gain as much as 20% in 2023, reflecting multiple positive developing tailwinds. While investors think EPS or Fed pivot signal bottom, this is an inflation cycle.

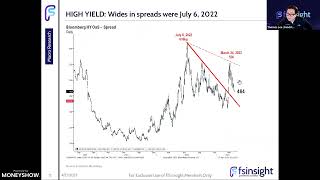

The year 2022 featured many challenges for investors, including higher inflation, higher interest rates, and poor stock and bond market performance. But it's a new year. And in 2023, investors should see less crisis and more opportunity. Tune in to this presentation to find out why.

Thomas Lee, founder of Fundstrat, employs technical analysis along with a fundamental approach. Lee says that markets are good at telling you want