If you’ve been following my work, you know I’ve been advocating a bullish “Be Bold” investing stance since the start of 2023. That means favoring offensive strategies and sectors over defensive ones, and generally staying long stocks, long precious metals, and long risk assets.

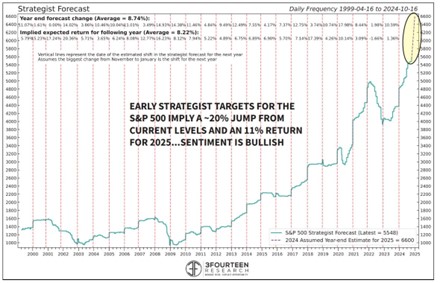

But now, Wall Street STRATEGISTS are jumping on the bandwagon...in a BIG way. Oppenheimer Asset Management is just the latest example, publishing a 7,100 year-end 2025 target for the S&P 500. Several other firms like Wells Fargo, Deutsche Bank, and Yardeni Research are all looking for moves to around 7,000, too, as you can see in my presentation slide from the MoneyShow Masters Symposium Sarasota last week.

So, with Wall Street getting so bold, should you...FOLD?

Take a look at the MoneyShow Chart of the Week here. It highlights the work of 3Fourteen Research. The firm’s founder Warren Pies noted on X that the magnitude of the current bullish strategist shift is the largest he has ever seen. So yes, that’s modestly concerning.

But as some of our MoneyShow contributors have pointed out, sentiment works better as a contrarian indicator at BOTTOMS than TOPS. In other words, extremely bearish sentiment readings tend to signal sharp upside reversals better than extremely bullish sentiment readings tend to signal sharp downside reversals.

Long story short? I wouldn’t “fold” just because Wall Street strategists are getting bolder. But I would play my cards closer to the vest. That means being less aggressive when allocating capital, legging into stocks or ETFs versus buying all at once. And if you’re trading leveraged vehicles like options shorter term, you might want to wait for a pullback before adding long exposure – rather than going “all in” here.