Your parents may have told you that good things come in small packages – if only to keep you and your brothers or sisters from fighting over Christmas presents! But when it comes to the STOCK market in 2024, the opposite holds true.

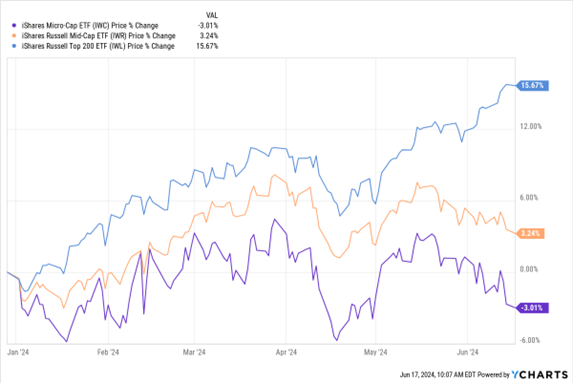

Take a look at today’s MoneyShow Chart of the Week below. It shows the year-to-date performance of the iShares Micro-Cap ETF (IWC), iShares Russell Mid-Cap ETF (IWR), and iShares Russell Top 200 ETF (IWL).

The IWC tracks the 1,000 smallest members of the Russell 3000 Index, plus the next 1,000 smallest companies. The IWR tracks around 800 of the smallest issuers in the Russell 1000 Index. Finally, the IWL tracks roughly 200 of the largest issuers in the Russell 3000 Index.

Data by YCharts

It’s not hard to identify a pattern here. Large caps (+15.6%) are outperforming mid-caps (+3.2%). And mid-caps are outperforming micro-caps (-3%).

A look at the SECTOR breakdown of each ETF tells more of the story. Technology (36.3%) is the top sector in the large-cap ETF, with healthcare (12.4%) a distant second. Industrials (20%) have the biggest weighting in the mid-cap ETF, with tech (13.6%) in third place. As for the micro-cap ETF? Health care (25%) and financials (20%) are the top sectors. Tech (11.1%) is all the way down in fourth place.

In other words, you’re getting “less tech” the further down the cap ladder you go. And in a year where “Big Tech” has dominated, that’s going to cost you.

What could change this dynamic? More optimism about economic growth is the likeliest trigger to me. That would lead investors to scoop up shares of economically sensitive names in groups like industrials, materials, and financials. It would also prompt investors to rotate into laggards that haven’t moved as much yet.

If you’re looking to get AHEAD of that, now might be a good time to start exploring some of the market’s smaller stocks. You never know what you might find.