Last week, most of Wall Street was focused on “Big Tech.” And I get it. The earnings reports and resulting market reactions from Meta Platforms Inc. (META), Microsoft Corp. (MSFT), and Alphabet Inc. (GOOGL) were big news – and very tradable.

But me? I’m also focused on the Japanese yen. No...REALLY!

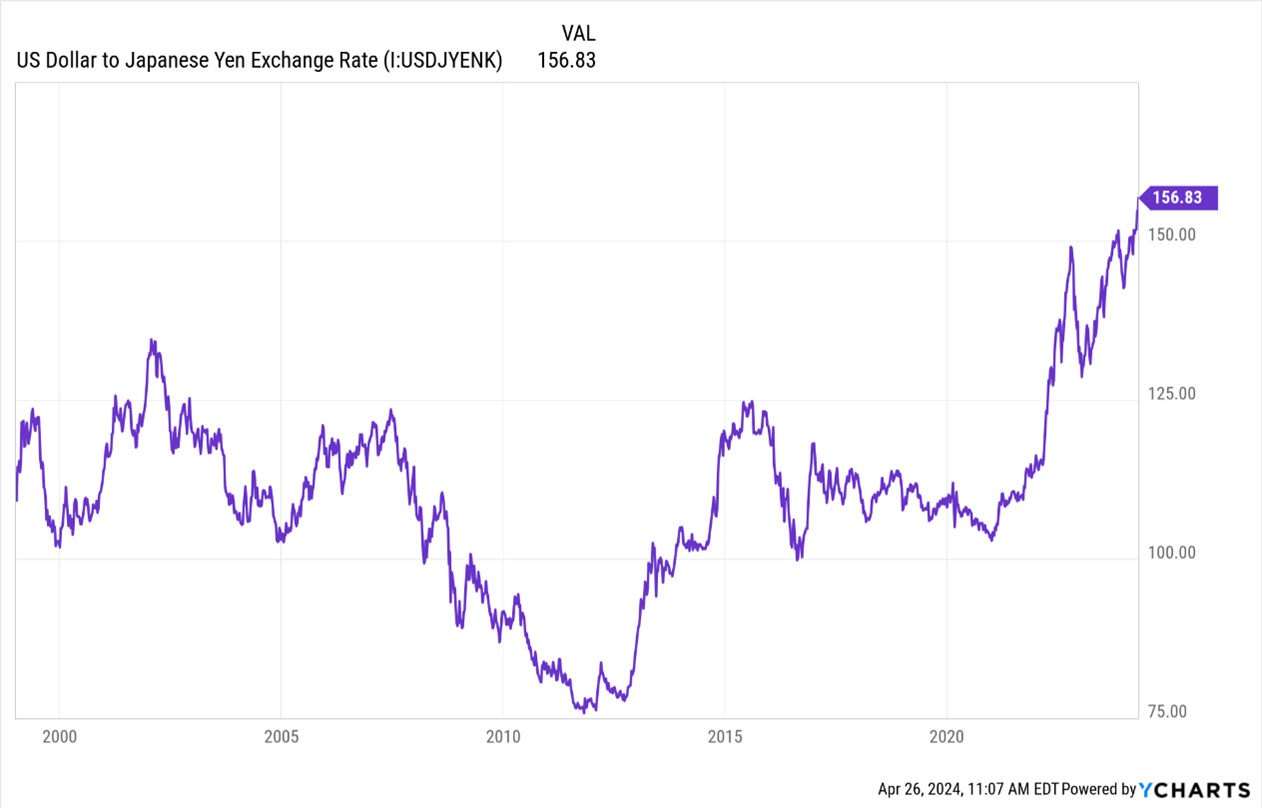

Look at this chart of how many yen each greenback buys. You can see the rate approached 157 yen to the dollar at the end of last week. That’s the highest the dollar has traded against the yen since 1990. The move extended the greenback’s year-to-date gain against the yen to more than 10%.

Data by YCharts

Now we come to the “Who cares?” part of the story. If you’re a currency trader, of course, you can either make (or lose) a lot of money on moves like these. But the potential impact could be much broader.

Start with markets in general. Many global investors are involved in so-called carry trades – borrowing in yen at rock-bottom rates, selling the currency, and buying assets in other markets and currencies where yields are higher.

But import costs for Japanese consumers and companies rise as the yen falls. The falling yen also raises global trade tensions by giving Japanese exporters a leg up on exporters in other countries with stronger currencies. Japanese authorities could be forced to respond by intervening aggressively to support the yen. They reportedly took the first step in that direction overnight.

If the intervention gets surprising or strong enough, it could lead to carry trades unwinding. Result? Mass dumping of assets like stocks and bonds. Some think the falling yen could also pressure US interest rates higher by making our bonds less attractive to Japanese investors, who hold a sizable chunk of our government debt.

Bottom line? Keep the yen in the back of your mind as a risk factor. Its slump doesn’t mean you sell your stocks. But if it really starts accelerating, or if we get a major intervention-driven reversal, expect to see more volatility!