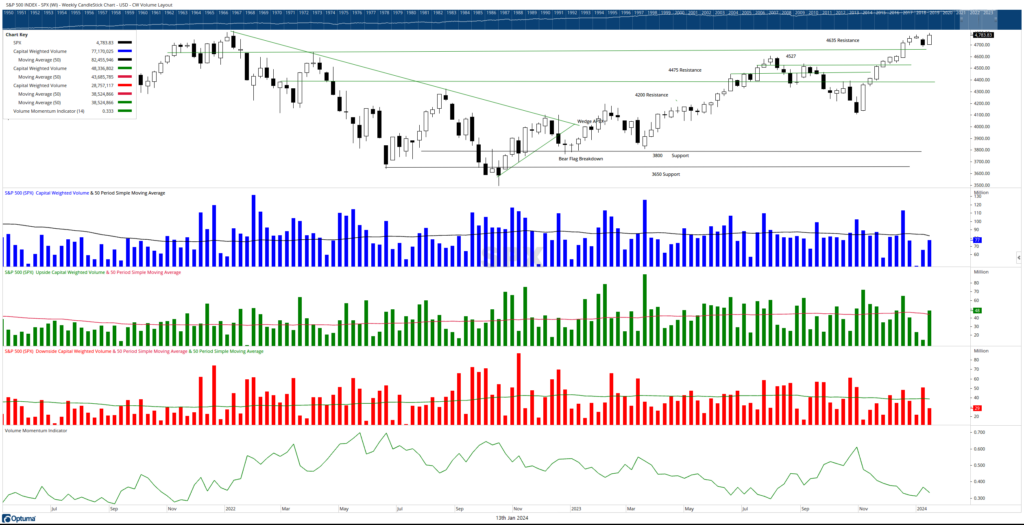

For the first full weekly session after a two-week hiatus, capital flows remained subdued despite the S&P 500 (SPX) reaching new 52-week highs, explains Buff Dormeier of Kingsview Partners.

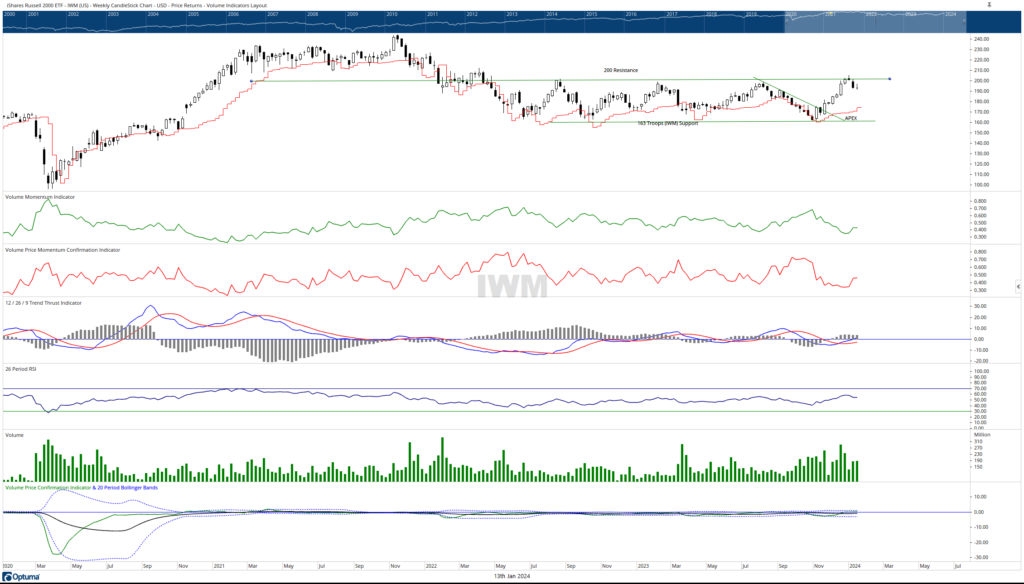

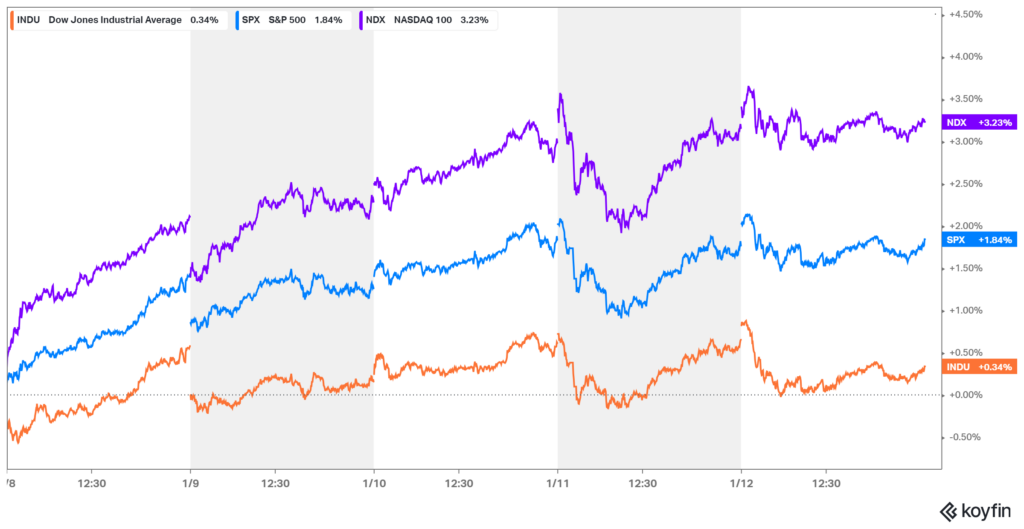

Upside capital flows maintained an average pace, while downside capital flows were below average. From a pricing perspective, the S&P 500 closed the week near its 52-week high, marking a 1.84% increase. The generals (NDX 100) led with a robust 3.23% gain, while the troops (IWM / iShares Russell 2000 ETF) remained largely flat for the week.

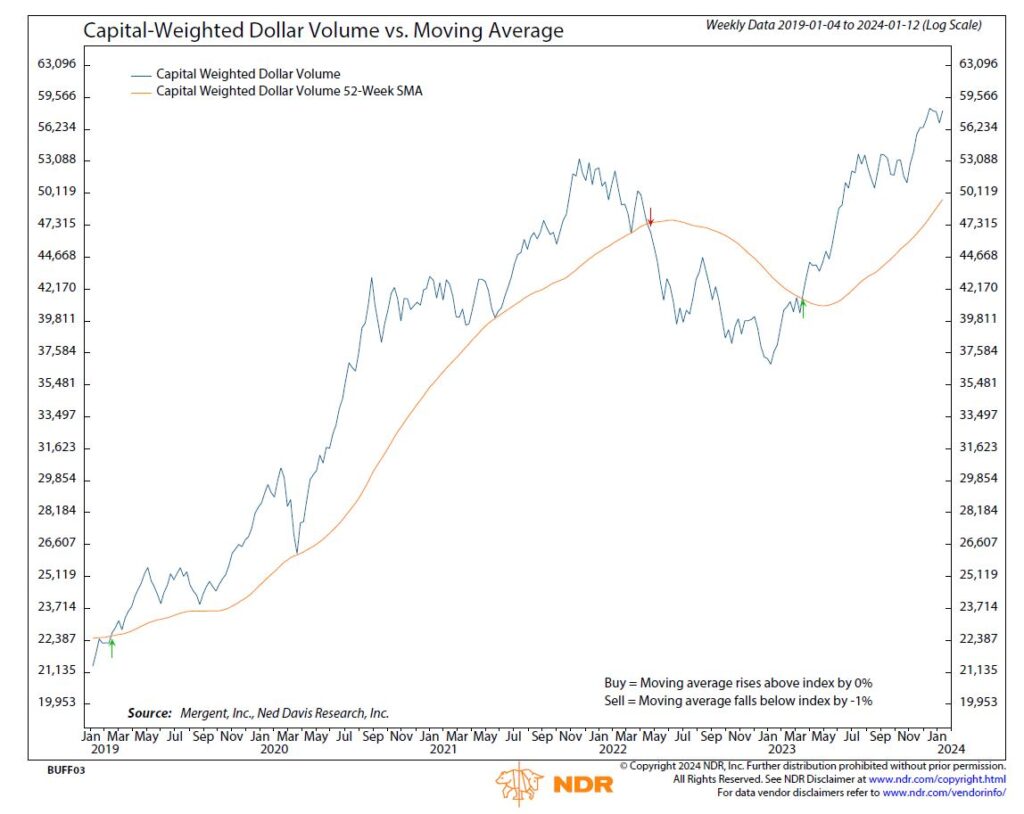

At first glance, these conditions may seem favorable, but a more in-depth analysis reveals some potentially concerning developments. Unlike the S&P 500’s price action, S&P 500 Capital Weighted Dollar Volume Flows, although advancing, fell just short of its December all-time high peak. Additionally, accumulated Capital Weighted Volume barely eked out a positive gain. In the long term, volume continues to take precedence over price, signaling its bullish leadership role. Conversely, in the short term, price has surged to the forefront, taking the lead in present market dynamics.

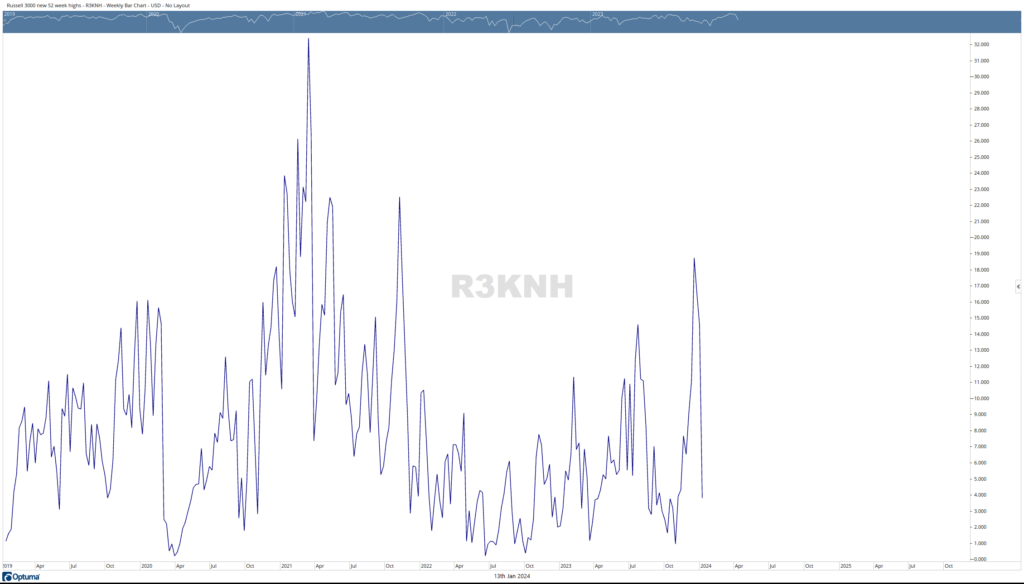

Switching gears to examine market breadth, the NYSE Advance-Decline Line closed the week lower. Additionally, the number of stocks making new 52-week highs in the Russell 3000 saw a significant drop. This data holistically may suggest that the broadening out trends proposed back in October might be temporarily suspended.

Focusing on the troops (the iShares Russell 2000 ETF) in isolation, IWM’s volume momentum indicators (Volume Momentum Indicator, Volume Momentum Confirmation Indicator) hit 52-week lows during December’s peak. While this indicates positive long-term prospects, in the short term, it suggests that the market’s rapid ascent may have gone too far too fast. Using a health analogy, the broad markets resemble a well-conditioned athlete capable of achieving great heights. However, it may have surged too far ahead over the short term and may benefit from a recovery breather before marching onward.

Learn more about Buff Dormeier here.