An understanding of covered-call writing must include debunking the myths associated with this strategy. When certain concepts are repeated often enough, they become accepted as truths whether they are accurate or false, explains Alan Ellman of The Blue Collar Investor.

1. Covered-call writing should be used in flat markets only

Truth: This strategy can be crafted to succeed in all market conditions. We accomplish this by selecting the most appropriate underlyings in bull (more volatile) and bear (less volatile) markets and the best options in bull (out-of-the-money) and bear (in-the-money) markets. We are also prepared with our bull/bear exit strategies.

2. Focus in on stocks & and options that generate returns

Truth: Option premium is directly related to the implied volatility of the stock or exchange-traded fund (ETF). Covered-call writing is a conservative strategy with capital preservation a key requirement. By selecting high-IV stocks, we are converting the strategy to a risky one. Instead, set up an initial time-value return goal range that will manage the risk we are subjected to (2% - 4% in my case).

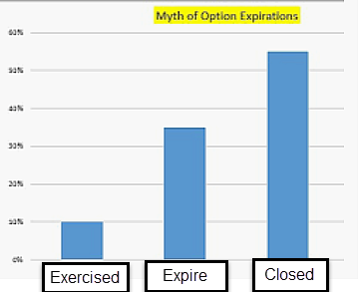

3. 90% of all options expire worthless

Truth: 10% of options are exercised but the other 90% includes 55% that are closed and 35% that expire worthless as shown in this chart:

Option Expiration Chart

4. Sell winners and retain losers

Truth: When we sell a covered call, we are accepting an obligation to sell the stock. However, that commitment can be cancelled by closing the short call or rolling the option. Mastering the exit strategy skill will leave us in control. The same holds true for under-performing stocks. We can first buy-to-close the short call and then sell the stock. As we manage our positions, our portfolio will consist of elite performers that generate initial time-value premiums that meet our conservative goals.

5. Sell options prior to an earnings reports

Truth: Never sell an option prior to an earnings release. There is too much risk associated with a disappointing report. Allow the report to pass and then write the call if the underlying meets our system requirements. Covered-call writing is a conservative strategy where we can generate dependable modest returns that will beat the market on a consistent basis. Risk is to be avoided, not embraced.

Discussion

A critical component to our financial education is to debunk the long-standing myths pervasive in our society. By mastering the three-required skills (stock selection, option selection, and position management), we will unmask the truths of covered-call writing and create opportunities to achieve the highest possible returns as we beat the market on a consistent basis.

Learn more about Alan Ellman on the Blue Collar Investor Website.