Stocks surged to close out last week, and they’re showing subdued gains in the early going so far this week. Crude oil is higher amid geopolitical tensions, while gold and silver are rising again, too. Treasuries and the dollar are flattish.

This week is a busy one for economic data. Home price and consumer confidence readings are coming out tomorrow, Q2 GDP hits on Thursday, and personal income and spending (plus PCE inflation) data will be released on Friday. Softer numbers on the growth and inflation front will only amp up Federal Reserve easing bets, which got a big “Powell Push” after the Fed Chairman’s Friday speech.

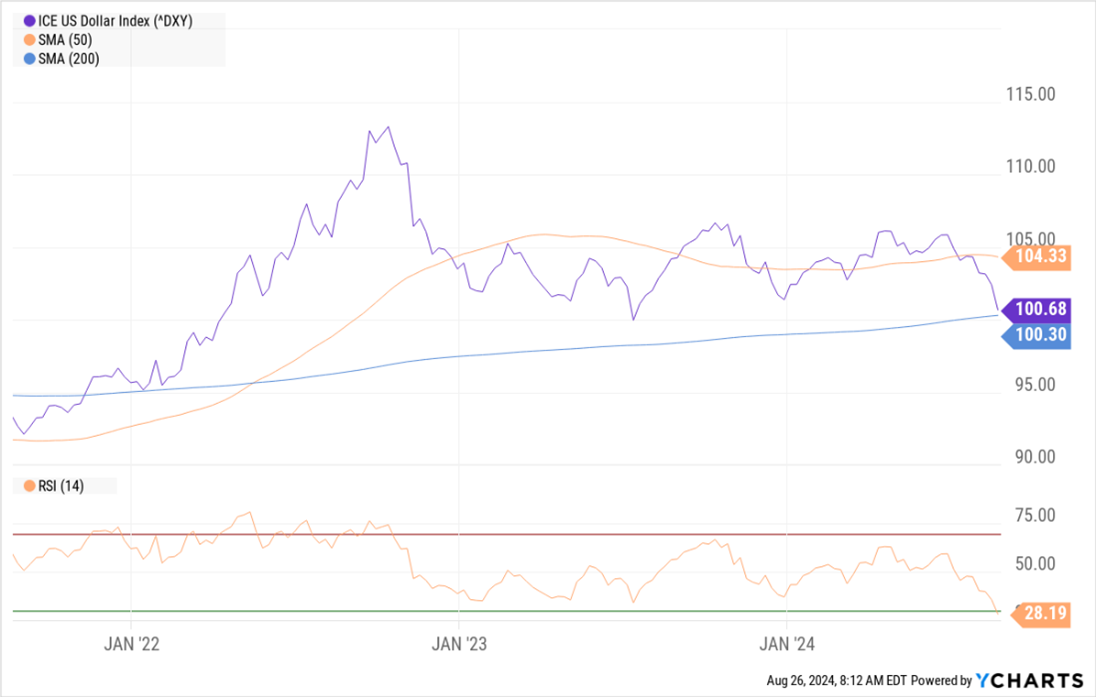

Talk of more easing has driven down the dollar, too. That is one reason why gold prices are hitting fresh all-time highs. It’s also helping global stocks perk up a bit. The SPDR MSCI ACWI ex-US ETF (CWI), a fund focused on foreign equities, is up 4.5% in the last 60 days to its highest since January 2022.

ICE US Dollar Index (DXY)

Data by YCharts

The biggest name in the tech sector – Nvidia Corp. (NVDA) – will report earnings after the bell on Wednesday. That report will likely help set the tone for tech stocks heading into the final month of Q3. Other names on the earnings docket this week include Salesforce Inc. (CRM) and Best Buy Co. (BBY).

Israel and Hezbollah traded fire over the weekend, with Israel bombing Hezbollah missile sites in Lebanon and Hezbollah firing aggressive rocket salvos into Israel. Crude oil prices rose, though both sides signaled today they were willing to de-escalate the conflict. Israel recently struck a building in Beirut, killing a key Hezbollah leader – and leading to fears of retaliation.