The iPath Bloomberg Commodity Index Total Return ETN (DJP) is designed to provide exposure to the Bloomberg Commodity Index, explains exchange-traded fund expert Jim Woods, editor of the Weekly ETF Report.

The fund tracks a broad index of 22 different commodity contracts with maturity ranging from one to five months. As an exchange-traded note (ETN), DJP is backed by the well-known Barclays Bank PLC.

The Bloomberg Commodity Index reflects, in the management’s words, “returns that are potentially available through an unleveraged investment in futures contract on physical commodities comprising the index plus interest.”

The index that DJP tracks allocates 31% to energy, 23% to grains/oilseeds, 17% to industrial metals, 15% to precious metals and roughly 7% each to softs and livestock. To avoid concentrated holdings, the index caps exposure to any single commodity sector at 33% and exposure to individual commodities at 15%.

As a result of this policy, many investors turn to DJP for diversification in their portfolios. Interestingly, DJP attempts to create a fair representation of each commodity’s importance to the world’s economy.

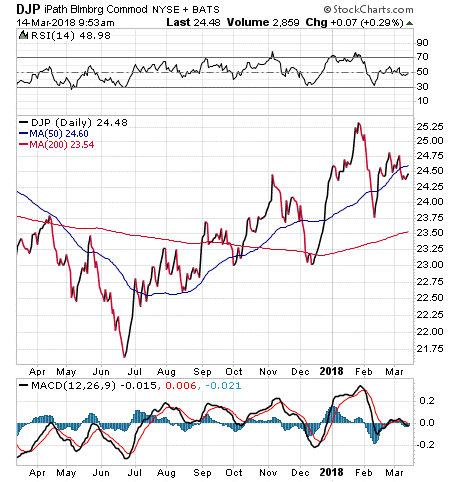

DJP has returned 1.58% in the past year and 0.22% year to date. The mediocre performance of DJP and commodities in general can partially be attributed to the drop in oil prices over the last several months. Some analysts predict that upcoming inflation will lift DJP, which, like many commodity funds, is used by investors as a hedge against inflation.

DJP has $1.10 billion in assets under management and an expense ratio of 0.70%. DJP’s top holdings and their respective weightings are: gold (11.87%), natural gas (8.55%), Brent crude (7.62%), WTI crude oil (7.55%) and copper (6.93%).

For investors who are seeking a convenient way to make a play on the commodities market, I encourage you to look into the iPath Bloomberg Commodity Index Total Return ETN (DJP).