With a yield of 2.8%, Federal Agricultural Mortgage Corp. (AGM) — or Farmer Mac – is driven by its mission to increase the accessibility of financing for American agriculture and rural infrastructure, highlights Tim Plaehn, editor of Monthly Dividend Multiplier.

As a secondary market for the nation’s agricultural and rural infrastructure credit, the company provides financial solutions to a broad spectrum of customers supporting rural America, including agricultural lenders, agribusinesses, and rural electric cooperatives. It’s also uniquely positioned to facilitate competitive access to financing that fuels growth, innovation, and prosperity in America’s rural and agricultural communities.

(Editor’s Note: Tim Plaehn is speaking at the 2025 MoneyShow/TradersEXPO Las Vegas, which runs Feb. 17-19. Click HERE to register)

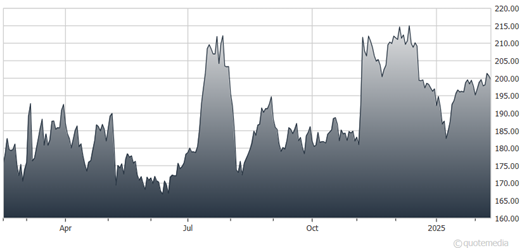

Federal Agricultural Mortgage Corp. (AGM)

Backed by the US government, the company can borrow at a low cost of debt and deploy cash into agricultural loans. We also have to consider that farm lending is only set to increase.

In 2024, for example, the volume of farm operating loans increased for the fourth consecutive quarter. Fueling even more excitement, “US farmers retained their post-election optimistic outlook at the start of the new year, according to the January Purdue University/CME Group Ag Economy Barometer,” as noted by AgWeb.com.

In its most recent quarter, results were a bit light. EPS of $4.10 missed by a penny. Revenue of $91.5 million, down 5.7% year-over-year, missed by $630,000.

Still, according to President and CEO Brad Nordholm: “Farmer Mac delivered another solid quarter, demonstrating yet again the benefits of our successful efforts to continue to diversify our revenue streams, taking advantage of our strong capital base and uninterrupted access to low-cost capital.”

It also continues to maintain its strong capital position with total core capital of $1.5 billion, which exceeds requirements by 66%.

We also have to consider that the Trump Administration could endorse more payments to American farms, which would call for more equipment upgrades and better financing.

Recommended Action: Buy AGM.