On Oct. 17, Netflix Inc. (NFLX) released its Q3 earnings report. By the end of the next day, the stock had already shot up by 8.3%. The earnings call was a big success. But should you buy NFLX shares? Here’s our take, notes Steve Reitmeister, editor of Zen Investor.

The company’s revenue grew 15% year-over-year, margins increased to 30% compared to last year’s 20%, and earnings per share came in at $5.40 — marking a 6% beat relative to consensus estimates of $5.09.

From a financial health perspective, Netflix's debt-to-equity ratio stands at 1.22, a major improvement from 3.9 five years ago. Free cash flow surged to $2.2 billion and paid membership increased by a whopping 35% from the last quarter.

In terms of guidance, the company is forecasting 15% revenue growth for the next quarter — opting for the high end of prior estimates. Plans are also in motion to increase pricing for premium and standard plans across various key markets.

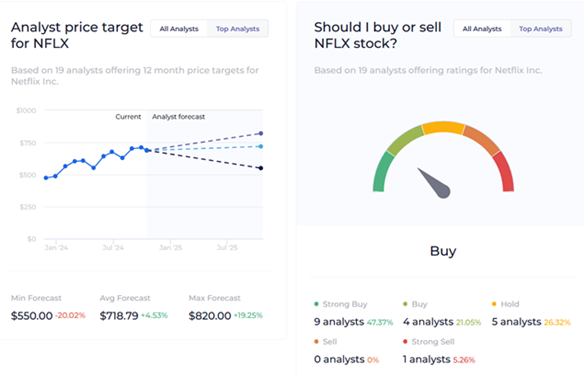

So, let’s turn to Wall Street for a moment. In total, 19 top equity researchers issue ratings for the stock. It’s a consensus “Strong Buy,” with an average price target of $718. However, that may change in the near future. It’s likely we’ll be able to get a better reading on how the experts feel in the coming weeks, as plenty of those ratings will no doubt be updated.

There is one thing to note, however — the three researchers who have issued the most up-to-date ratings are significantly more bullish. All three of them - Guggenheim’s Michael Morris, Jason Helfstein of Oppenheimer, and Morgan Stanley’s Benjamin Swinburne - are all rated in the top 10% of all equity analysts.

The average upside of their forecasts is +16.5%. While it’s a far cry from the stock’s YTD gains, if achieved, it would still represent twice the market’s annual return of the S&P 500.

For now, investors should exercise caution. The last two quarters saw instances of profit-taking that created temporary price dips, and if we get another one, it could serve as a more attractive entry point for a long position. That would also be a point where more Wall Street analysts will have issued new ratings, allowing investors to make the decision based on a wider range of estimates.

Recommend Action: Look to buy NFLX on a dip.