US stocks have been rising again. Tech gains helped push the S&P 500 to a record high, and the Dow Jones Industrials gained 432 points in Wednesday’s trading. The economic soft landing story has gained more traction in recent days. One domestic stock fund I like is Fidelity Blue Chip Growth Fund (FBGRX), writes Brian Kelly, editor of Money Letter.

Despite geopolitical risks and the uncertainty surrounding the Nov. 5 election, the markets are being driven higher by these four factors: 1) Fed easing is underway; 2) Global economic data doesn’t point to recession; 3) Credit has already eased as cuts by the Fed have been anticipated for months; 4) Seasonality is in investors’ favor.

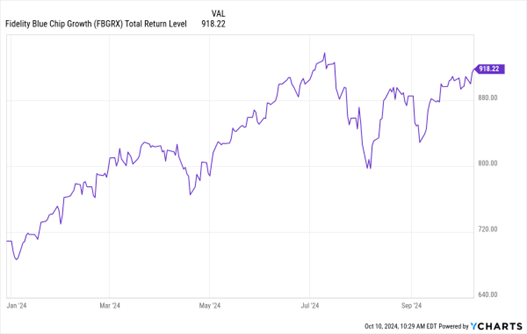

Data by YCharts

It was mostly a positive week for our four global indices. For the Hotline reporting period (Oct. 3 – Oct. 9) the S&P 500 advanced by 1.4%; the Euro Stoxx 50 was up by 0.4%; the Nikkei 225 added a strong 3.9%; and the Shanghai Composite, after gaining 27.5% between Sept. 20 and Oct. , lost 6.6% on Wednesday to post a 2.3% decline for the reporting period.

As for FBGRX, the fund seeks growth of capital over the long term. It normally invests at least 80% of assets in blue chip companies (companies that, in Fidelity Management & Research Company LLC (FMR)'s view, are well-known, well-established and well-capitalized), which generally have large or medium market capitalizations. It invests in securities of domestic and foreign issuers.

The fund uses fundamental analysis of factors such as each issuer's financial condition and industry position, as well as market and economic conditions, to select investments. The fund is non-diversified.

Recommended Action: Buy FBGRX.