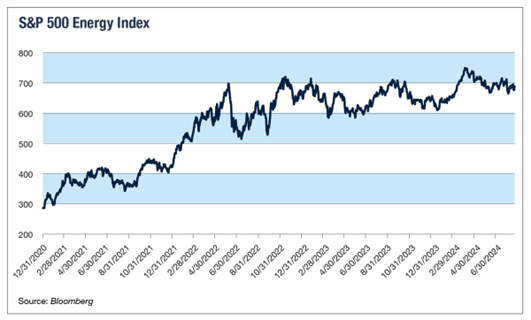

Year to date, the S&P 500 Energy Index is ahead 10.2%, including dividends. Not surprisingly, it’s energy prices — not interest rates, politics or even company earnings — that are mainly driving sector stock prices. I like Baker Hughes Co. (BKR), counsels Elliott Gue, editor of Energy and Income Advisor.

The Philadelphia Oil Service Sector Index (OSX) is basically flat at 0.1% YTD. And the midstream focused Alerian MLP Index is still leading the sector with a 17.1% return, including dividends.

(Editor’s Note: Elliott Gue is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

Three-plus years into what’s shaping up as an historic “up” cycle, the big institutions and trillion-dollar passive funds that dominate the US stock market are still chronically under-invested in energy. That won’t last forever. And when the money does start to come over, you’re going to want to be on board for a wild ride.

As for BKR, shares of the energy technology and drilling services company are ahead by 4.9% so far in 2024. Year-to-date returns include three quarterly dividend payments of 21 cents per share.

Despite noting sluggish activity in the US, Baker favorably surprised investors by raising its guidance range for 2024 EBITDA to $4.4 billion to $4.6 billion, from the previous range of $4.1 billion to $4.5 billion. That was off a tightened revenue range, now $27.6 billion to $28.4 billion, as recent efficiency measures raised margins 150 basis points to 15.8% of revenue.

Ultimately, services companies do better when oil and gas producers’ activity is surging. That’s not the case now, as dipping oil and especially natural gas prices have reinforced industry conservatism — especially in North America outside selected areas like the Permian Basin and Gulf of Mexico.

These results, however, show once again that Baker is finding ways to expand its reach while weaker sector players are blown back by headwinds. And that bodes well for investor returns later in the cycle, when perennial late-joining services firms are usually the biggest winners.

Recommended Action: Buy BKR.