The latest housing data is in, and it’s not pretty. May is usually the best season for buying and selling houses. Yet fewer existing homes were sold that month than in April. That said, if we see more government investing in housing, or lower interest rates — or both — then we get more homebuilding activity. You could profit by targeting the SPDR S&P Homebuilders ETF (XHB), advises Sean Brodrick, editor at Weiss Ratings Daily.

Sales were down 2.8% from a year ago in May, according to the National Association of Realtors. Why? Well, one reason is that tight supply means prices keep going up. US home prices hit an all-time high in May, with the median home price nationwide jumping 5.8% from the prior year. The median home price across the US was $419,300, up from $396,500 in May 2023.

(Editor’s Note: Sean Brodrick is speaking at the 2024 MoneyShow/TradersEXPO Orlando, which runs Oct. 17-19. Click HERE to register)

To counter market weakness, states are already investing in housing. The federal government seems to be moving toward housing investment on a grander scale, too. That could give builders a boost. But even if the politicians don't get it right, lower interest rates could still provide a tailwind.

There are ETFs that will let you potentially profit from those trends. The one I like the most is XHB. It has an expense ratio of 0.35% and a recent dividend yield of 0.69%. The fund uses an equal-weight, blended strategy with a mix of growth and value stocks. The fund invests in home builders, building product suppliers, and home improvement retailers.

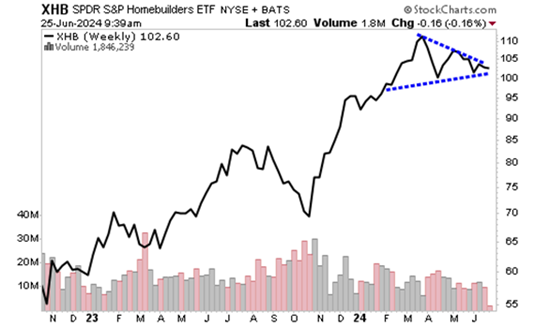

Now, here’s a weekly chart …

You can see that XHB has been consolidating since April. It’s probably coiling up for a big move. But in which direction?

With the housing market as tight as it is, I believe the next move could be higher…to $150 or more. From XHB’s current price of $100 and change, that could represent almost a 50% increase from here.

Recommended Action: Buy XHB.