General Electric was the quintessential dividend growth stock in the 1990s. It made many millionaires through price appreciation and a rising payout. Eventually, the company ran into problems during the subprime mortgage crisis and the Great Recession. But today, the “new” GE Aerospace (GE) is an attractive company focusing on commercial and defense markets, explains Prakash Kolli, editor of Dividend Power.

We discuss GE because the company has returned from its travails. It recently split into three corporations: GE Aerospace, GE HealthCare Technologies Inc. (GEHC), and GE Vernova Inc. (GEV). GE HealthCare is a medical device firm, while GE Vernova holds most of the old electrical and power businesses.

GE Aerospace (GE)

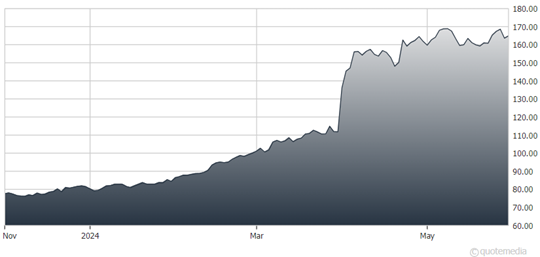

The legacy firm is GE Aerospace, which became the General Electric Company. The stock price has been the highest since 2016, with good results and optimism about the aviation business. However, it is still short of its all-time high share price and market capitalization.

The firm produces solid results with higher revenue, profit, and free cash flow. Debt and leverage are down, too, and the company has a BBB+/Baa1 lower-medium investment-grade credit rating.

Notably, GE has changed its capital allocation strategy to invest organically in growth, return cash to shareholders via buybacks and dividends, and perform M&A. As a result, we view General Electric as a dividend growth stock again.

Two of the three spun-off companies pay dividends, while GE Vernova does not yet. General Electric’s dividend was notably boosted 250% to $0.26 per quarter from $0.08.

It will be many years before GE returns to its former dividend growth glory and Dividend Aristocrat status, but it has a path to get there now.

Recommended Action: Buy GE.