The only “break” we’re getting on inflation is that prices are now increasing at a slightly slower rate. But they’re still rising. So Wealth Builders like us look for ways to protect ourselves – or, even better, to find the clues that signal an opportunity. Clues like the latest earnings report for Walmart Inc. (WMT), explains Bill Patalon, chief stock picker at Stock Picker’s Corner.

When the latest US inflation numbers made their way into the headlines this week, they told us that consumer prices had risen at a 3.4% rate in April. That was a bit better than the 3.5% rate for March – and prompted a couple of major news outlets to talk about how consumers were “getting a breather” or “getting a break” from the inflationary pressures that have been pummeling them for the last several years.

Those headlines made me laugh…out loud…because I know (at the risk of oversimplifying things) that it literally “doesn’t work like that.” You see, regular consumers – folks like us – don’t care about “inflation,” per se. We care about prices. And those prices are 20%, 30%, and 40% higher than they were four years ago.

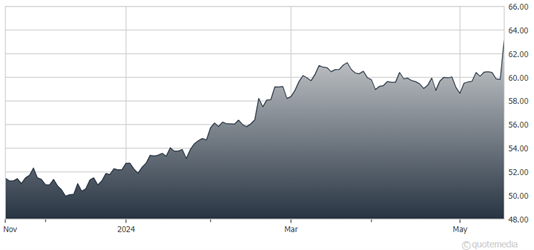

Walmart Inc. (WMT)

But the case we’ve made is that Walmart is turning this inflationary mess into one big opportunity for itself. One example: We said that the Arkansas-based retailing giant is targeting – and winning over – the high-income consumers who haven’t traditionally graced its aisles. And Walmart’s first-quarter earnings report says that we’re right. After all, no matter what your paycheck looks like, no one likes paying more than they have to.

In its “Next Act” narrative, you can throw in how Walmart can shrewdly and quietly boost its sleepy ad business through the pending acquisition of Vizio. Walmart generated $3.4 billion in revenue from this segment in 2023, compared to Amazon.com Inc. (AMZN) hauling in $50 billion. And on top of that, you can also add how Walmart is better using data analytics to drive decision making.

Plus, while it’s not a hefty yield, Walmart still rewards shareholders with a dividend of 83 cents a share (for a yield of 1.39%). Walmart is a prime example of a stock you can “accumulate” your way into. Buy a foundational stake – and add to your holdings on pullbacks or as you get more cash.

Recommended Action: Buy WMT.