The best contrarian indicator on the planet is in play (again). Namely, US equity funds just saw a fifth successive week of outflows. According to Refinitiv Lipper, investors pulled $4.54B from US equity funds, which was driven by “risk aversion,” explains Keith Fitz-Gerald, editor of 5 with Fitz.

Anybody who doesn’t understand investing psychology is at a tremendous disadvantage in today’s financial markets. Let me explain.

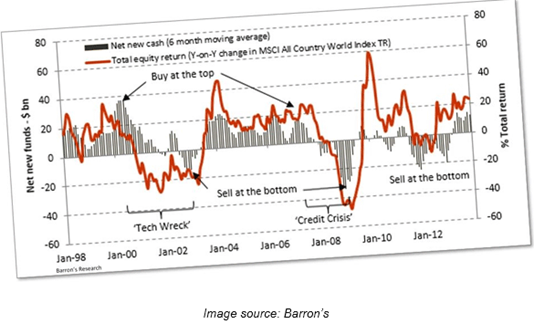

Research from Barron’s, DALBAR, and others shows that 80% or more of all buy/sell decisions are wrong, meaning that investors sell when they should be buying and buy when they should be selling.

Why? There’s actually a simple explanation.

Herding, for lack of a better term, is very real. And it’s getting worse because the internet has created a tremendous need for social validation.

At the same time, individual investors are reluctant to realize losses even when they should. Professionals don’t have that problem, which is why this is such a great juxtaposition.

Finally, many individual investors are overconfident in their ability to predict the future, yet at the same time fearful that “everybody else” knows something they don’t. Which is why many armchair experts have consistently predicted 10 of the last 2 recessions. [doh!]

Well, guess what’s happening? Money has come out of the stock market. Talk about a great contrarian signal!

I’ve always believed that anybody can be wildly successful in the stock market with the right information, education, and tactics.

Learn! Find a mentor. Learn some more! Every day is a new opportunity.