About Erin

Erin Allen headshot and bio — Erin Allen, vice president of ETF online distribution with BMO ETFs, has been part of the team driving growth since the beginning. For the past five years, she has been working closely with capital markets desks, index providers, and portfolio managers to bring new ETFs to market that address the evolving needs of investors. Ms. Allen is committed to helping empower investors to feel confident in their investment choices through ETF education. She hosts the weekly ETF Market Insights broadcast, delivering ETF education to DIY investors in a clear and concise manner.

Erin's Videos

In this session, we explore the evolution of factor ETFs and delve into how quality investing works. We will look at different approaches to measurement, and why this factor may hold up across different market environments. From the general risk-return profile to the nuts and bolts of MSCI’s methodology, Paul Riccardella of MSCI and Erin Allen of BMO ETFs will uncover the truth about quality ETF investing and how it can fit in your portfolio.

The growth of covered call ETFs has led to a broad range in distribution yields on the different products, each with its own set of choices and trade-offs. In this session, we explore what drives the yield on a covered call ETF. We explore key considerations an investor can use to make an informed decision when investing in these solutions. Balancing a reliable source of cash flow while generating growth from an investment portfolio is the key objective for many investors. Sophisticated investors know that there are trade-offs to be made but may not know what those are. We will discuss the various approaches to covered call strategies, their benefits, and their implications for one’s portfolios, all with the goal of helping investors determine the right mix for their own investment objectives. BMO ETFs is the leading covered call ETF provider by AUM, and number of listings1, with many of our ETFs having over a 10+ years track record. Our ETFs aim to provide yield you can trust for access to growth and cash flow.

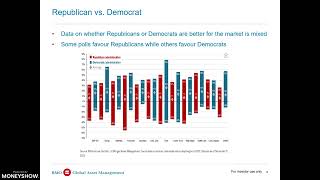

Markets are impacted by a wide variety of factors including economic data, monetary policy, earnings, and more. In this session, we dive into the historical relationship between elections and markets and its potential implications for your investment portfolio this year. How will the rematch of Biden vs. Trump, a match many Americans don’t want, play out for the markets and the economy? We will look at solutions to help you manage volatility, stay the course, and maintain discipline in your investment journey.