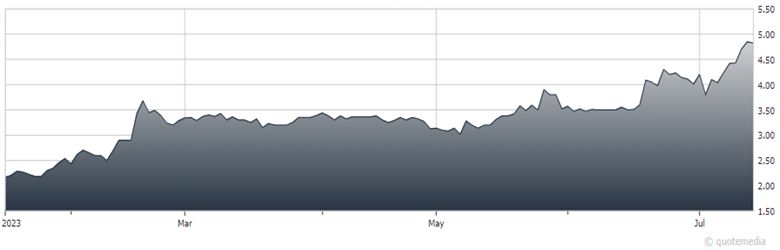

Editor’s Note: Gerardo del Real, editor at Junior Resource Monthly, had the second-best performing recommendation from our annual “Top Picks 2023” Report through mid-year. The Canadian miner Bravo Mining (BRVO.V) produced a total return of 83.1% during the tracked period. I reached out to him recently for updated commentary and guidance on the stock, and this is what he provided...

Despite the Luanga project already trading at a discount, the potential for a game-changing massive sulphide nickel discovery at depth is the real prize and one I expect to catapult the stock much higher.

On June 13, the company announced it had discovered the first evidence of such a discovery in the Central Sector. Highlights included 45.2 metres at 1.89g/t PGM+Au, 0.20% Ni; 50.0meters at 1.79g/t PGM+Au; And 1.0 meter at 1.51% Ni.

Bravo Mining (BRVO.V)

“Recent drilling in the Southwest Sector (DDH23LU142) has intercepted the first evidence of magmatic nickel sulphide mineralization outside that previously intersected in the North Sector. This indicates the potential for nickel sulphides at depth along the entire 8.1km strike of the Luanga project. Coupled with the continuing evidence of elevated levels of disseminated nickel sulphides throughout the Central Sector, a HeliTEM survey across the entire Luanga land package has begun, designed to find indications of massive sulphides targets,” said Luis Azevedo, Chairman and CEO of Bravo.

“The Phase 2 drill program is progressing as planned, with drilling completed to date (assays pending). This shows where drill coverage is heading and where future results will come from as we begin to explore the next 150m interval of mineralization vertically below the top 150m defined by historical work and Bravo’s Phase 1 program.”

I expect results from the long-awaited EM survey any day now and if positive, I expect the share price to continue its ascent towards C$10.00.

Recommended Action: Buy BRVO.V.