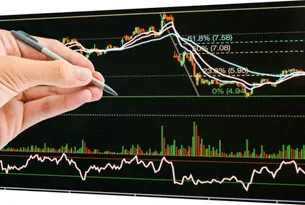

Defining Risk Through Fibonacci Analysis

Carolyn Boroden is a technical analyst specializing in Fibonacci analysis. Her unique form of price and time analysis is quickly proving to be one of the most promising trading techniques using Fibonacci available today. Ms. Boroden's first book, Fibonacci Trading: How to Master the Time and Price Advantage, was published by McGraw-Hill in early 2008. She is currently running a trading room at Elliottwavetrader.net.

Trending Now

Filter By Category

Filter By Keywords

Discover how institutional traders move the markets and learn to trade alongside them using real-time options flow data. In this session, we’ll break down how to interpret large block orders, sweeps, and volume spikes—leveraging SensaMarket’s 100+ pre-built strategies to maximize your trading edge.

So, just what is a common-sense trading strategy? It does the following: your money grows in up-markets, down markets, and flat markets. Your money is liquid all the time. Get in or out anytime you want. And on top of all of that, you get to choose whether you want a 1x or 2x or 3x growth rate. Join Mike Turner, a world-class thought leader for money management, as he walks you through one of the most amazing common-sense and incredibly successful portfolio management processes you have ever seen and how easy it is to put this process to work for you today! No more guessing about what the market is going to do tomorrow or next week or for the rest of the year You’ll actually look forward to bear markets instead of being scared to death of them. Finally… A trading strategy that works in all markets!

So, just what is a common-sense trading strategy? It does the following: your money grows in up-markets, down markets, and flat markets. Your money is liquid all the time. Get in or out anytime you want. And on top of all of that, you get to choose whether you want a 1x or 2x or 3x growth rate. Join Mike Turner, a world-class thought leader for money management, as he walks you through one of the most amazing common-sense and incredibly successful portfolio management processes you have ever seen and how easy it is to put this process to work for you today! No more guessing about what the market is going to do tomorrow or next week or for the rest of the year You’ll actually look forward to bear markets instead of being scared to death of them. Finally… A trading strategy that works in all markets!