Follow

About Aaron

Aaron Dunn, CFA, is senior analyst at KeyStock.com, Canada's leading provider of independent, unbiased investment research on North American stock markets. A unique research firm, KeyStock.com has a near 20-year track record of identifying fundamentally strong and attractively valued stocks with outstanding results Mr. Dunn is passionate about helping individual investors navigate the financial markets and has over a decade of experience providing clients with specific buy/sell investment advice on small-cap and dividend growth stocks. He is a regular guest on Canada's number one financial radio show Money Talks with Michael Campbell. Mr. Dunn has a bachelor of commerce degree from Royal Roads University and is a CFA charterholder.

Aaron's Articles

EQB Inc. (EQB), operating primarily through its subsidiary Equitable Bank, is a growth-oriented, mid-size Canadian bank that differentiates itself with a tech-driven approach to banking and a focus on niche markets, explains Aaron Dunn, senior equity analyst at KeyStone Financial.

Brookfield Infrastructure Partners (BIP) is a global infrastructure company with a portfolio of high-quality, long-life assets that generate stable cash flows and support a stream of growing income distributions to investors. BIP is what we consider to be a core income and growth investment, notes Aaron Dunn, senior equity analyst at KeyStone Financial.

Aaron's Videos

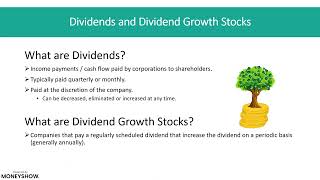

Equip yourself with the knowledge to make informed decisions and seize exciting opportunities in the stock market while managing risks effectively. This presentation addresses key questions crucial to your investing success: How can select dividend growth stocks provide an edge? What role should commodities play in your portfolio? Is AI a generational investment opportunity, and how can you leverage it? What level of US market exposure is optimal for Canadian investors? To conclude, we'll unveil our top three stock picks for 2024. Join us to convert these insights into actionable investment strategies and develop a profitable stock portfolio that thrives under a wide range of economic conditions.

Join us to demystify the essentials of intelligent stock investing, as we demonstrate how to create a profitable stock portfolio that combines the dependability and cash flow of dividend-growing companies with the transformative potential of technology innovation stocks. This presentation aims to equip investors with strategies and tools to identify opportunities, make smart investment decisions, and avoid common mistakes. We highlight how to tailor a portfolio to balance growth, stability, and income according to your unique goals and needs. Learn how dividend growth stocks can provide a solid foundation for your portfolio and discover how investing in exciting themes such as technology, generative AI, and developments like ChatGPT can supercharge your investment returns. At the end of the presentation, we will provide you with 4 of our Top Stock Picks which exemplify the principles discussed and get you started with building a profitable stock portfolio in 2023.

Aaron Dunn describes how to build a manageable portfolio. The key is to only select profitable companies with positive cash flow and avoid the high profile stocks in "hot sectors.

In this "Meet the Experts" series, we asked our investing and trading experts to share their background, investment strategies, and preview their presentations at the upcoming MoneyShow Toronto.