Omanand Karmalkar

BMO ETFs

About Omanand

Omanand's Videos

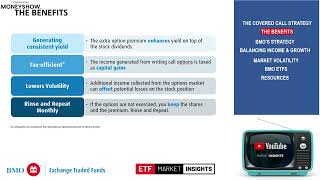

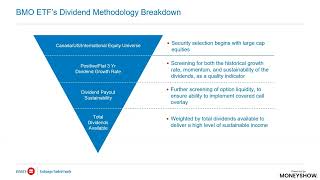

The growth of covered call ETFs has led to a broad range in distribution yields on the different products, each with its own set of choices and trade-offs. In this session, we explore what drives the yield on a covered call ETF. We explore key considerations an investor can use to make an informed decision when investing in these solutions. Balancing a reliable source of cash flow while generating growth from an investment portfolio is the key objective for many investors. Sophisticated investors know that there are trade-offs to be made but may not know what those are. We will discuss the various approaches to covered call strategies, their benefits, and their implications for one’s portfolios, all with the goal of helping investors determine the right mix for their own investment objectives. BMO ETFs is the leading covered call ETF provider by AUM, and number of listings1, with many of our ETFs having over a 10+ years track record. Our ETFs aim to provide yield you can trust for access to growth and cash flow.