About Jeffrey

Jeffrey A. Hirsch is CEO of Hirsch Holdings, editor-in-chief of the Stock Trader's Almanac and publisher of Almanac Investor at www.stocktradersalmanac.com. Jeff is the author of The Little Book of Stock Market Cycles (Wiley, 2012) and Super Boom: Why the Dow Will Hit 38,820 and How You Can Profit from It (Wiley, 2011). He worked with founder Yale Hirsch for over twenty years, taking over for him in 2001. A 35-year Wall Street veteran, he appears on CNBC, Bloomberg, Fox Business, and many other financial media outlets. Now in its 58th year, the Stock Trader’s Almanac has been published every year since 1968.

Jeffrey's Articles

Jeffrey's Videos

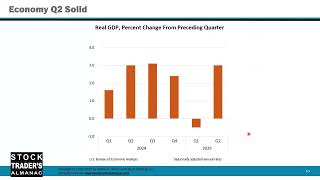

The summer rally is losing steam just as August and September—the market’s historically weakest months—come into view. With inflation pressures mounting, tariffs returning to the headlines, and political uncertainty rising, timing is everything. Join Jeff as he breaks down his critical NASDAQ Best 8 Months MACD Seasonal Sell Signal, what it means for your portfolio now, and how he's adapting to the shifting landscape of rates, politics, and seasonality. Don’t miss his top picks, defensive plays, and tactical ETF moves to ride out the late-summer volatility and position for a stronger Q4.

MoneyShow's editor-in-chief, Mike Larson, is joined by panellists Tom Bruni, Jeff Hirsch, and Sean Brodrick to discuss the markets and what stocks they think you should keep an eye on.

Market volatility has been bullishly crushed and in the process the rally has triggered a host of other bullish technical readings. Tune in for Jeff’s mid-year market forecast update and the new international ETF trades he’s recommending. June is the end of NASDAQ’s Best 8 Months. You’ll get the update on his Seasonal MACD Sell Signal trigger and what to expect for the perennial mid-year rally.

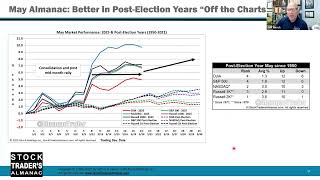

The “Worst Six Months” of the year, May-October, AKA “Sell in May,” are underway. It’s time to reevaluate your portfolio. In this volatile post-election year market, it critical not to sell willy-nilly. Jeff will rundown ETFs to avoid and the best sector ETFs to rotate into for the “Worst Six Months.” He will also share his updated outlook for the rest of 2025 and why Q3 may prove troublesome for stocks.

Jeffrey's Courses

Upcoming Appearances

Jeffrey's Books

The Little Book of Stock Market Cycles: How to Take Advantage of Time-Proven Market Patterns

Newsletter Contributions

Stock Trader's Almanac

The newsletter is your monthly guide to the stock market: data, indicators, seasonal patterns, and more.

Learn More