Follow

About Joe

Joe Laszewski is a senior portfolio manager with Stack Financial Management (SFM), a firm recognized by Barron's as one of the "Top 100 Independent Financial Advisors" in the US. Founded by renowned market analyst James Stack, SFM is known for its "safety-first" style of risk management. As a member of the portfolio management team, Mr. Laszewski's background in accounting and finance aids his focus on fundamental research and analysis. He is a Certified Public Accountant (CPA) as well as a Chartered Financial Analyst (CFA) charterholder.

Joe's Articles

Raytheon Technologies (RTX) is an aerospace and defense company that provides advanced systems and services for commercial, military, and government customers worldwide, explains Joe Laszewski, CFA, CPA and senior portfolio manager at Stack Financial Management.

Raytheon Technologies (RTX) is an aerospace and defense company that provides advanced systems and services for commercial, military, and government customers worldwide, notes Joe Laszewski, CFA, CPA and senior portfolio manager at Stack Financial Management.

Delta Air Lines, Inc. (DAL) is a primary international airline that provides service to every major domestic and international market, suggests Joe Laszewski, CFA, CPA and senior portfolio manager at Stack Financial Management.

Joe Laszewski, senior portfolio money manager at Stack Financial Management, selected Walmart (WMT) as his favorite investment idea for 2019. The stock has since risen 19%. Here's his latest update on the retail giant.

Joe's Videos

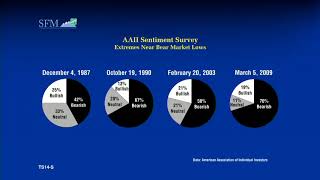

In this lively workshop, the SFM Portfolio Team will update the red flags signaling bear market and recession risks. More importantly, this seasoned team will reveal the time-tested tools and tactics that can confirm whether a bear market is in place, and how to identify that once-in-a-decade buying opportunity at the bottom.

Join in this gathering of the Portfolio Team of Stack Financial Management as they reveal their secrets for constructing an all-weather portfolio that is built to grow assets and preserve wealth through extreme market volatility. Learn the best sectors and industries to invest in now, and specific stock ideas that are a "must own" for any investor seeking safety-first profits.