About Patrick

Pat Donnelly is vice president of capital markets at Tudor Gold and has a broad range of experience in mineral exploration, capital markets, corporate development, and investor relations. He holds a Bachelor of Science degree in geology with honors from the University of British Columbia and has an MBA from the University of Toronto.

Patrick's Articles

Patrick's Videos

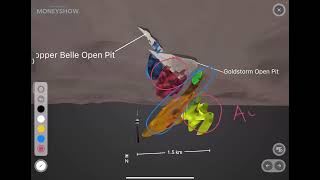

In 2019, Tudor Gold's exploration team, under the leadership of the company's president and CEO, made a significant discovery with the Goldstorm Gold-Copper deposit, boasting nearly 28 million gold equivalent ounces. Following this discovery, Tudor Gold has continued to conduct further exploration on this asset, leading to the identification of a promising high-grade zone known as Supercell One, which has now become the company's primary focus. Learn more about Tudor Gold and how we are committed to delivering value for our investors through our ongoing exploration efforts and the development of our exciting new discovery.