MARKETS, MONEY MANAGEMENT, STRATEGIES

Keith Richards

ValueTrend Wealth Management

- Founded ValueTrend Wealth Management

- Author of Sideways: Using the Power of Technical Analysis to Profit in Uncertain Times

- Frequent Contributor on BNN Bloomberg Television, Globe and Mail, Toronto Star, and Reuters

About Keith

Keith Richards has been in the securities industry since 1990 and is a highly regarded member of the small, exclusive community of Chartered Market Technicians in Canada. As president and chief portfolio manager of ValueTrend Wealth Management, he and his team manages a discretionary investment service for high-net-worth clients. Mr. Richards' articles appear regularly in the MoneySaver. He also writes a very popular trading blog at www.valuetrend.ca. His appearances on BNN Television have inspired producers to acknowledge him as "one of [our] most accurate technical analysts." Mr. Richards' has written three books on investing, including SmartBounce: 3 Action Steps to Portfolio Recovery, Sideways: Using the Power of Technical Analysis to Profit in Uncertain Times, and Smart Money, Dumb Money: Beating the Crowd through Contrarian Investing. He has also produced a comprehensive trading course designed to assist ordinary investors to invest like a pro.

Keith's Videos

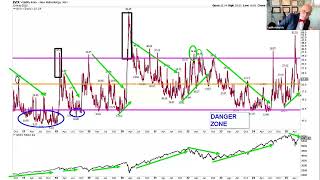

Join Keith Richards in this 30-minute session as he covers his current market targets and strategies for 2025.

Many investors get caught up in popular investment themes. They enthusiastically buy near the top, then fearfully sell near the bottom when the market corrects its excess. Conversely, the greatest investment returns in history have been made by betting against the crowd during extreme investor sentiment. But how do we know when the market has reached an opportunistic inflection point? Keith Richards' webinar will provide a bevy of contrarian analysis tools designed to help you identify an overbought and euphoric market. These same tools can help you profit by buying into an oversold market that has reached its capitulation stage.