About Inna

Inna Rosputnia is a professional trader, quantitative strategist, and CEO of Managed-Accounts-IR.com, where she runs automated trading systems powered by proprietary quantitative models. Her approach combines algorithmic precision with deep market structure insight, targeting opportunities in stock index and futures markets.

Ms. Rosputnia is the author of Basic Instinct of Trader, a practical guide to building mental discipline and tactical edge in the markets. Inna’s insights have been featured in Benzinga, Equities.com, Investing.com, and The Business Woman Media. Her leadership in finance has earned her multiple global awards, including Leading Innovator in Wealth Management and Most Outstanding Woman in Finance.

Inna's Articles

Inna's Videos

Discover the top 3 strategies to profit with alternative investments during market volatility. Learn how to leverage commodities, private market opportunities, and diversified funds to boost income, protect wealth, and achieve portfolio stability.

Join Inna Rosputnia, CEO of Managed Accounts IR, as she discusses the ways to build steady income streams. She will also share investing and trading ideas. Finally, Inna shares strategies and tactics you can easily apply to boost your profitability.

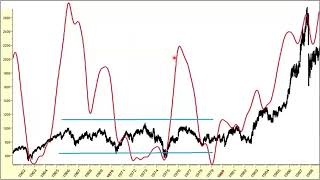

Join Inna Rosputnia, CEO of Managed Accounts IR, as she discusses the current stock market and makes a forecast for the second half of the year. Moreover, she uncovers how to identify recession, protect, and grow your capital.