ETFs, STRATEGIES

Lisa Hannam

MoneySense

About Lisa

Lisa Hannam is the editor-in-chief of MoneySense, Canada's most trusted lifestyle brand about all things money. MoneySense helps over 450,000 Canadians every month with personal finance, insurance, investing, and more. She has an extensive journalism background as an acclaimed writer and editor, spanning over 20 years, working for some of Canada's largest glossy magazines, daily newspapers, and popular websites. Ms. Hannam is a leading force in the success of MoneySense, creating some of the publication's most viewed and sought-after content. She writes and edits popular articles about personal finance, insurance, banking, investing, practical money tips, and more.

Lisa's Videos

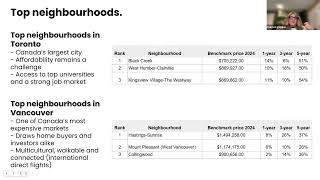

The real estate market can’t seem to catch a break, from pandemic lockdowns and inflation and now a tariff war. But there are opportunities for Canadian investors looking to diversify or grow with alternative assets, like real estate. To give you some insight into the markets Canada-wide, MoneySense teamed up with Zoocasa. They analyzed real estate data to reveal the regions and neighbourhoods offering the most value to Canadian buyers in 2025. Find out the top spots in Canada, the best neighbourhoods in Toronto and Vancouver, and what else the data reveals.

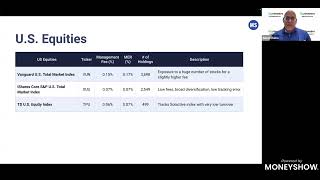

With more and more ETFs listed on Canadian exchanges, DIY investors have an overabundance of choice. It can be hard for investors to know which ETFs to put into their portfolios—should you stick with index-based ETFs or explore thematic and sector ETFs, for example? MoneySense breaks through the clutter with our annual ETF All-Stars Report—now in its 12th year. We’ll look at the makeup of today’s ETF market and which ETFs are worth considering.

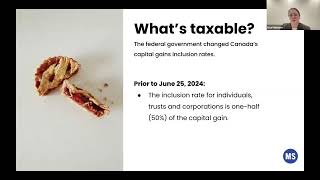

What should traditional and alternative investors in Canada know about the new capital gains tax changes? Find out in this session, as MoneySense Editor-in-Chief Lisa Hannam walks through what the changes mean and how they may impact investors. She will also answer the top five questions Canadians have about capital gains tax.

Canadian real estate investors are looking for relief from high-interest rates and inventory issues this year. To give you some insight into the markets—Canada-wide!—MoneySense teamed up with Zoocasa. They analyzed real estate data to reveal the regions and neighbourhoods offering the most value to Canadian buyers in 2024. Find out the top spots in Canada, the best neighbourhoods in Toronto and Vancouver, and what else the data reveals.