DIVIDEND, INCOME, REITs, STOCKS

Chris Barry

NNN REIT, Inc.

- VP of Corporate Communications and Investor Relations, National Retail Properties

- Member of the National Investor Institute and the International Council of Shopping Centers

- Member of the National Association of Real Estate Investment Trusts

About Chris

Chris's Videos

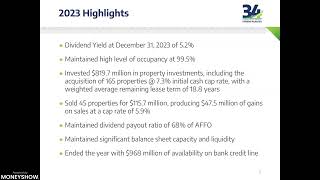

As markets ebb and flow, NNN REIT, Inc. (NYSE: NNN) remains well-positioned to react to macroeconomic and capital market challenges that may arise. For 40 years, NNN has applied a multi-year view to operating the company, focusing on producing consistent per-share results. This has enabled NNN to successfully navigate all types of market conditions and provide shareholders with solid, stable progress. NNN shareholders have enjoyed 36 consecutive annual dividend increases and a 30-year average annual total return of 11.0%. Join us and learn how NNN’s durable, dependable dividend income could provide a bit of consistency for your portfolio.

As the 2025 markets ebb and flow, NNN REIT, Inc. (NYSE: NNN) remains well-positioned to react to any elevated economic and capital market challenges that may arise. For 40 years, NNN has applied a multi-year view to operating the company, focusing on producing consistent per-share results. This has enabled NNN to successfully navigate all types of market conditions and provide shareholders with solid, stable progress. NNN shareholders have enjoyed 35 consecutive annual dividend increases and a 30-year average annual total return of 11.8%. Join us and learn how NNN’s steadfast, dependable dividend income could provide a bit of consistency for your portfolio.

By staying true to our decades-long strategy of taking a multi-year view to operating our company and focusing on consistent per-share results, NNN REIT, Inc. (NYSE: NNN) remains well-positioned to navigate the elevated economic and capital market uncertainties that companies will face in 2024. NNN has been able to successfully navigate all types of market conditions and provide shareholders with consistent, stable results including 34 consecutive annual dividend increases and a 30-year average annual total return of 11.0%. Join us and learn how NNN’s stable, consistent dividend income could fit into your portfolio.