About Jake

Jake Bernstein is an internationally recognized futures analyst, trader, and author. He has written more than 41 books, numerous research studies, and newsletters on futures trading, stock trading, trader psychology, and economic forecasting. Mr. Bernstein is the publisher of Jake Bernstein's Weekly Futures Trading Letter which is now presented in digital media format as The Jake Bernstein Online Weekly Capital Markets Report and Analysis.

Jake's Articles

Jake's Videos

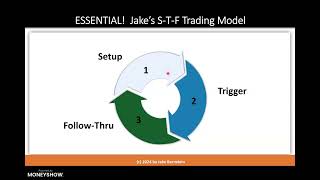

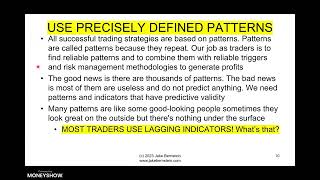

Profitable trading strategies implemented by traders with flawed discipline and subjective rules will lose money, no matter how good these strategies may be in back testing. Conversely, disciplined traders with objective rules can often make money even with marginally profitable trading strategies. This troubling gap between winners and losers cannot be narrowed to specific learning models designed to enhance confidence which improves discipline which, in turn, helps traders become winners. This unique presentation is not about trader psychology, but about specific methods new and experienced traders can use to improve their bottom-line results. Don’t miss it!

The artificial intelligence revolution has opened a new era in trading and investing. As in all cases of technological progress, the uses of game-changing tools may not be fully or even partially realized when they are developed. In this unique presentation, Jacob Bernstein will demonstrate at least five different ways that artificial intelligence can be used to improve trading and investment selections.

Drawing on his vast and extensive experience as a stock and futures trader since 1967, Jake Bernstein explains in detail the outstanding trading and timing indicator, XC, and its precise use in all markets and time frames. Joined by his associate and XC co-developer, Brian Latta, they will show how XC is used for timing and trend changes. XC is a highly stable 100% rules-based indicator developed specifically for capturing large moves early in their inception. As a long-time presenter at MoneyShow events, Jake's sessions have always delivered valuable tools and trading methods to serious traders keen to improve their results.

Jake's Books

The Compleat Day Trader: Trading Systems, Strategies, Timing Indicators, and Analytical Methods

The Investor's Quotient: The Psychology of Successful Investing in Commodities & Stocks

Stock Market Strategies That Work

Newsletter Contributions

Weekly Capital Markets Report

Every week since 1972, Jake Bernstein has published his Weekly Capital Markets Report. Issued in video format with graphically illustrated charts and signals, this approximately 30 minute report focuses on short-term, actively traded US futures markets as well as several European and Asian stock indices. While most newsletters lapse into meaningless subjective opinions and fundamental hyperbole, this report is all about the facts.

Learn More