The end of 2024 is in sight! Just over two weeks remain, which means markets will be thinning out soon for the holidays. So...where do things stand?

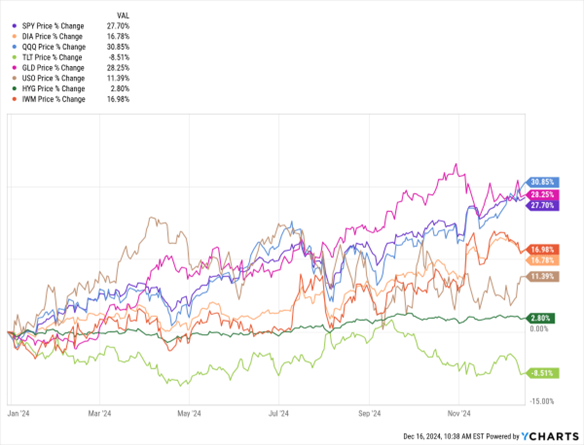

Take a look at the MoneyShow Chart of the Week below for an overview. It shows the year-to-date price performance for ETFs that track the S&P 500, Dow Jones Industrial Average, Nasdaq 100 Index, and Russell 2000, plus long-term US Treasuries, high-yield bonds, gold, and crude oil.

Data by YCharts

No doubt it’s been a GREAT year for stock investors. Even if you owned the SPDR Dow Jones Industrial Average ETF (DIA) or the iShares Russell 2000 ETF (IWM), you’ve made more than 16%. And if you owned the SPDR S&P 500 ETF (SPY) or Invesco QQQ Trust (QQQ), you’ve done even better – with gains of about 28% or 31%, respectively.

Long-term bonds haven’t done you any favors, with the iShares 20+ Year Treasury Bond ETF (TLT) down about 8% in price. But if you add in the yield you picked up along the way, it knocks that loss down a couple percentage points. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) has performed better because default fears and credit spreads have fallen. It’s up about 3% in price and 8% in total return terms.

As for commodities? The United States Oil Fund (USO) has risen around 11%, while the SPDR Gold Shares ETF (GLD) has surged 28%. Not bad. Not bad at all.

Of course, I could’ve thrown some of the Bitcoin ETFs in here. But they’d skew the scale of the chart given how strong the cryptocurrency has been! The Grayscale Bitcoin Trust ETF (GBTC) is up a whopping 143%, for instance.

You probably don’t need me to tell you. But 2024 has CLEARLY been a “Risk On” kind of year (or a “Be Bold” one if you want to use my lingo!) Expecting 2025 to be as strong as this year is probably too much of an “ask.” But I still don’t think we’re in for serious trouble in the next 12 months. Credit, economic, and market indicators still look positive to me!

Our offices will be closed during Christmas week, and I’ll be on vacation the Monday after. So, I want to take a moment to wish you a very happy holiday season! It has been a pleasure sharing my market views with you in 2024 – and I look forward to doing the same in 2025.