Remember what I wrote last week about “Trump Trades?” How Wall Street investors were snapping up select asset classes, sectors, and stocks that a new Trump Administration would likely help?

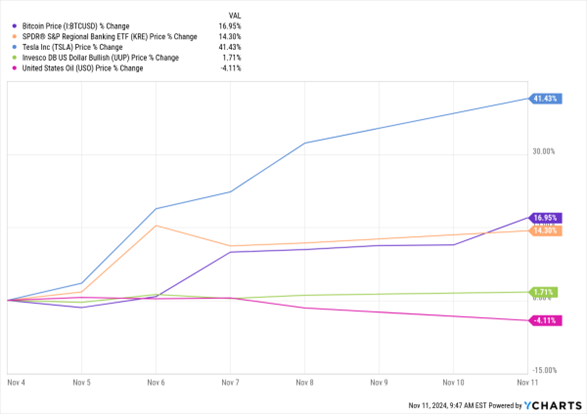

Well as you might expect, his election win fueled an EPIC follow-up move in those investments! That’s why I want to revisit the trend and short-term trading action for the MoneyShow Chart of the Week. This new chart shows the performance of Bitcoin, the SPDR S&P Regional Banking ETF (KRE), Tesla Inc. (TSLA), the Invesco DB US Dollar Index Bullish Fund (UUP), and the United States Oil Fund (USO).

Bitcoin, KRE, TSLA, UUP, USO (1-Week % Change)

Data by YCharts

You can see that Bitcoin, regional bank stocks, and Tesla shares have all surged in the last week. The dollar has also risen by a fairly large amount (for a currency, anyway), while crude oil prices have dropped.

Again, the fundamental catalyst is shifting policy priorities under a Trump Administration. The president-elect has pledged to take a lighter regulatory approach to cryptocurrencies and crypto-related firms. He has also spoken about the creation of a national Bitcoin reserve (similar to the Strategic Petroleum Reserve that began storing oil in 1977).

Investors also think Trump will dial back restrictions and regulations that apply to traditional banks and financial firms. Tax reform and growth-friendly policies could pad profits and lead to lower loan losses going forward, too – a pair of additional positives for bank stocks.

As for Tesla? CEO Elon Musk and his super PAC spent more than $175 million to help get Trump in office...and investors expect he’ll get benefits in return. That could include less regulation of the company’s self-driving car technology. Plus, Musk’s other businesses – like SpaceX – will surely see more federal contracts and dollars thrown their way.

When it comes to the dollar, Trump’s affinity for tariffs is driving the rally. Slapping tariffs on foreign trading partners could weaken their economies relative to ours. That could also drive up inflation, preventing the Federal Reserve from cutting interest rates as much as was previously expected. Relative interest rates are a key driver of relative currency valuations.

Finally, “drill, baby, drill” has long been one of Trump’s rallying cries. Easier regulatory policy and the opening up of more federal land to drilling will give domestic oil explorers and producers an operational boost. But it will also increase global oil supply, putting downward pressure on prices. Hence, the move in USO.

As I said before, big-picture economic trends are more important than politics when it comes to market moves over the longer term. But it’s clear that traders aren’t worried about that for now. Which means profits can be had if you’re nimble, and you understand what’s driving the action you see on your screen!