Now, THAT’s what I call rotation!

After languishing for ages, smaller capitalization stocks came roaring back over the past couple weeks. Meanwhile, the “Big Tech” stocks that had been leading markets tumbled across the board.

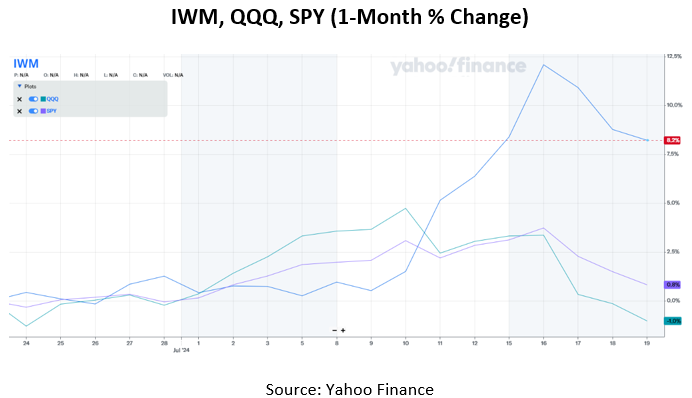

Just look at the MoneyShow Chart of the Week for July 22, 2024. It shows the 1-month percentage change in the iShares Russell 2000 ETF (IWM), the Invesco QQQ Trust (QQQ), and the S&P 500 ETF Trust (SPY). You can see the IWM has risen more than 8% during that timeframe, while the QQQs have shed 1% and the SPY is barely in the black.

On a shorter-term timeframe, the action is even starker. In a recent seven-day stretch of trading, the Russell 2000 outperformed the S&P 500 by the widest margin since data was first collected in 1986. And it’s not just a capitalization issue. Value stocks also outperformed growth stocks by the most since 2001.

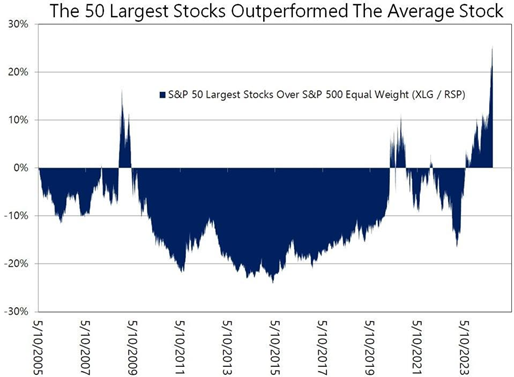

This comes after a dramatic stretch of underperformance for smaller, less-expensive stocks. Only last month, I showed you how even within the Russell Index this year, larger-cap stocks were outperforming mid-cap stocks, which in turn were outperforming micro-cap names. The same thing has been true in the S&P 500, as you can see in this chart from Forbes.com.

Source: Path Financial, via Forbes.com

The burning question for investors now is simple: Will the rotation CONTINUE? Or in other words, is this a big-picture trend shift...or just short-term trading action that’ll reverse soon?

Reasonable people can disagree. Plenty are online and on television. But you can put me in the “big picture shift” camp.

I think investors are looking for new winners, new sectors, and new investments in a new interest rate and economic regime. That doesn’t mean tech will tank. But it does likely mean smaller-cap, value-style names in sectors like financials, energy, industrials, and materials will outperform. Gold and gold miners, too.

So, my advice is: “Don’t fight it. Embrace it.”