Israel’s military operation against Iran’s nuclear proliferation is called “Operation Rising Lion” but they can also call it “Operation Rising Oil Prices” as it no doubt has impacted the price of energy. Despite wild predictions of what may happen in this type of event, price increases have been relatively modest. However, this operation is raising costs, and we can see it in real time, advises Phil Flynn, senior energy analyst at The PRICE Futures Group.

After a big surge higher on the opening recently, oil prices pulled back as it became clear that the attack had done little damage to Iran’s oil production capability or its ability to export oil. Both sides have a vested interest in keeping the oil flowing, at least in the short term, unless Israel decides that they will have to take out that infrastructure to finally subdue the Iranian regime.

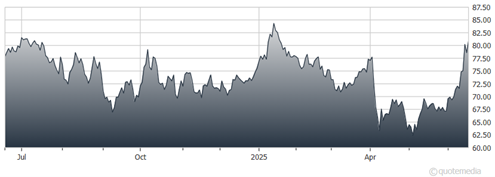

United States Oil Fund (USO)

Just when it seemed we were going to get an uneasy calm, oil prices ran back up after President Trump on Truth Social said that: “Iran should have signed the ‘deal’ I told them to sign. What a shame, and waste of human life…Everyone should immediately evacuate Tehran!” This statement followed Israel’s evacuation warning for parts of Tehran and came amid escalating Israel-Iran airstrikes.

Trump also left the G-7 meeting early as concerns about the situation in the Middle East sent him back to Washington. He told reporters on Air Force One that his warning was for safety, saying, “I want people to be safe… It’s always possible something could happen.”

That possibility has been raising the price of oil – and tanker rates – and it’s an example of how risk premium in oil is priced in real time. Tanker rates for vessels carrying refined oil from the Middle East have surged due to Israel-Iran tensions, making the Strait of Hormuz riskier. Shipping costs to East Asia rose nearly 20% in three sessions through Monday, while rates to East Africa increased by over 40%.

While increases have been seen on gasoline prices and oil during this conflict, the diesel and diesel crack spread continues to lead the price increase. The reason is the Israeli strike on the Sharon oil depot in Tehran. It’s a major hub for diesel and other fuel distributions. This could raise concerns about potential supply disruptions for diesel. Iran is a significant producer of medium-heavy sour crude grades, which are ideal for refining distillate fuels like diesel.

We advise our clients to monitor crack spreads. With higher supply risks and tanker rates, our daily trade levels help identify profit points and buy-back opportunities.