First things first. We had a potential SETUP for a tradeable market bottom heading into Tariff Day. But it got blown to pieces when President Trump unveiled a tariff plan that was much more aggressive than Wall Street imagined. So…back to the drawing board there.

Meanwhile, the immediate, post-announcement market reactions smacked of rising recession risk. Stocks dropped along with the dollar. Oil collapsed. Treasuries soared. Even gold, the strongest safe haven to date, sold off for a bit before stabilizing.

But it’s early…right? This could be only a short-term – if painful – market selloff, correct? Here’s where watching the markets over the next few weeks will prove instructive.

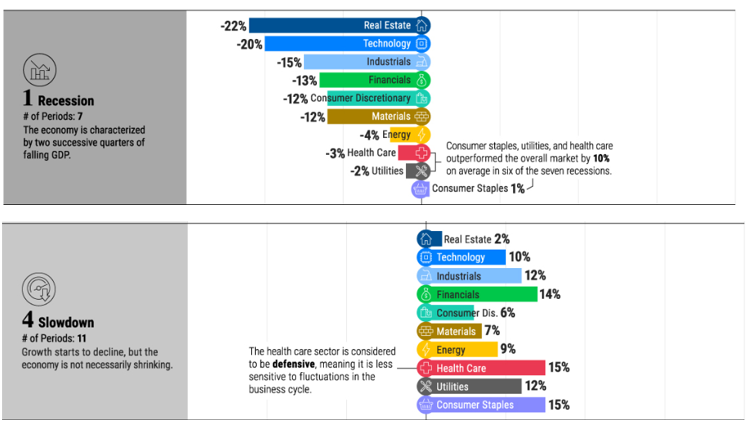

Take a look at this MoneyShow Chart of the Day. It shows excerpts from a Visual Capitalist infographic detailing which sectors tend to perform best (and worst) when the economy is slowing down...and when it’s in recession.

Source: Visual Capitalist

IF we’re truly in longer-term trouble, you’re going to see consumer staples, healthcare, and utilities get bought like crazy…while you’re going to see technology, consumer discretionary, real estate, and industrial stocks get sold.

My advice? Keep things like the Consumer Staples Select Sector SPDR (XLP), Health Care Select Sector SPDR (XLV), and Utilities Select Sector SPDR ETF (XLU) on your trading screens. Ditto for the Technology Select Sector SPDR ETF (XLK), Industrial Select Sector SPDR (XLI), and Consumer Discretionary Select Sector SPDR (XLY). Track how they perform relative to each other in the coming days and weeks.

If pre-recessionary and recessionary sectors start taking the lead CONSISTENTLY, it’ll be a clear sign to get more defensive in your trading approach.