We’re in interesting times indeed. Wednesday’s “Liberation Day” speech sent equities spiraling lower. But there’s a thread of good news: The tariff impact could send the Big Money Index into oversold territory, writes Lucas Downey, co-founder of Mapsignals.

While the market pullback is painful and nauseating to sit through, I firmly believe much of this tariff tit-for-tat will ultimately resolve itself…eventually. Instead of me opining on the what-ifs, the better strategy is to follow the money flows. It’s in cold, hard data where clarity exists.

We’ve been through so many unprecedented events before including Covid-19, the bear market of 2022, and other steep drawdowns. Our Big Money Index (BMI) helped us navigate every single period…ultimately to better days.

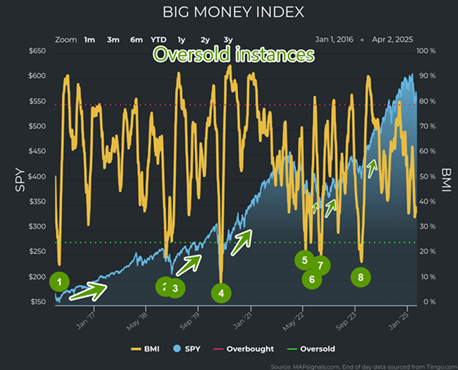

It takes a lot of weakness to send our BMI into the green zone. I like to say that the Big Money Index is the final indicator that’ll reach an oversold status. It’s a slow-moving indicator tracking big institutional footprints. During times of extreme uncertainty, this barometer has led the way.

Here’s where we are today (38%) and I’ve highlighted all oversold moments since 2016. A true oversold BMI reading is 25% or lower…

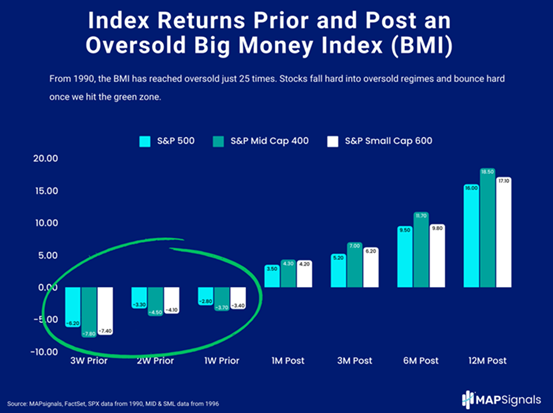

Back to 1990 (including back-testing) we’ve reached oversold only 25 times. Here are the important takeaways:

- First, small-, mid-, and large-caps suffer in the weeks leading into an oversold reading. Correlation hits 1 as all stocks drop.

- Second, this is the most important development. Once we are oversold, it often ignites a wicked breath-taking rally.

Note the path below. As we get closer to the green zone, stocks begin to firm up before a powerful melt up.

Our data was trying to firm up over the past week…but the latest tariff impact could send the Big Money Index oversold…and that’s a great thing! I can’t dismiss the discomfort that market drawdowns inflict. But it’s important to keep a steady head and focus on best-of-breed companies.

If and when we reach a rare oversold BMI, you’ll want to bet on the outliers loved by institutions. That’s where our process shines. Don’t get lost trying to keep track of daily headlines. Follow the money flows.

Subscribe to the Mapsignals newsletter here…