Daily volatility continued in the most recent week. Only four of the eleven S&P SPDR sectors were higher last week. Meanwhile, the major averages and stocks remain below key moving averages, with overhead resistance above, advises Bonnie Gortler, CEO of Bonniegortler.com.

Consumer staples and energy were the strongest sectors, while communication services and technology were the weakest sectors last week. The SPDR S&P 500 ETF Trust (SPY) fell 2%.

S&P SPDR Sector ETFs Performance Summary 3/21/25 – 3/28/25

Source: Stockcharts.com

Investor sentiment, as measured by the Fear and Greed Index (a contrarian index), closed at 22. That’s in the extreme fear zone, often where good buying opportunities arise – but not yet as rally attempts have stalled quickly.

NYSE New Lows

Source: Stockcharts.com

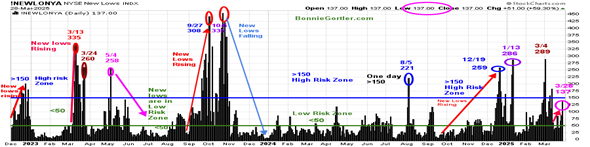

New Lows on the NYSE rose in December 2024, with a high of 259. They briefly contracted before peaking at 286 (purple circle) on 1/13/25 and then contracted.

New lows in 2025 have hit the "high risk" zone a few times and then contracted. Last week, New Lows increased again to 137 (pink circle), just under the zone. Watch New Lows to see if New Lows expand above 150, implying an increased risk of the downtrend accelerating...or falling below 100 and contracting between 25 and 50, which would be positive for the short term.

Uncertainty regarding tariffs, interest rates, and inflation is not helping investor confidence. Intermediate momentum patterns are falling and are not yet in a favorable position. Short-term momentum patterns have turned up but to no avail.

The risk of the decline accelerating exists unless buyers step in quickly, holding the March lows for a short-term bottom to occur. Manage your risk and your wealth will grow.

Follow Bonnie Gortler’s work here…