Sem-EES. And Sem-EYES. Both serve as good economic and market indicators. Unfortunately, neither looks encouraging here.

Semiconductors are the building blocks of the technology sector. Chips go into EVERYTHING. So, ideally, you want to see semiconductor stocks rallying strongly.

As for the 18-wheel-variety of semis, they’re the workhorses that get raw, intermediate, and finished goods from point A to point B. You want to see them rallying strongly – along with other transportation stocks like railroads, airlines, and shipping companies.

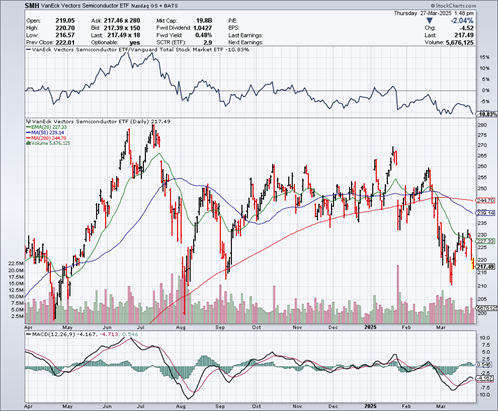

But here is the first MoneyShow Chart of the Day – the VanEck Vectors Semiconductor ETF (SMH). The fund owns big-cap names like Nvidia Corp. (NVDA) and Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) as well as smaller ones such as ON Semiconductor Corp. (ON).

SMH (1-Year Chart)

As you can see, the SMH peaked all the way back in the summer of 2024. It tried to recapture those highs at the start of this year, but failed. Then it broke down on heavy volume, re-tested that breakdown, and failed again – plunging down out of range that dated back to September of last year.

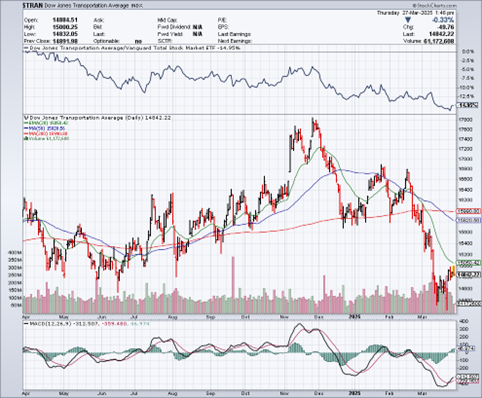

Next, you have the Dow Jones Transportation Average, one of the “grandaddy” indices that dates back to 1884. Membership has changed over the years. After all, Charles Dow never envisioned a company like Uber Technologies Inc. (UBER), much less had the chance to put it in his index.

But it does contain truckers like Old Dominion Freight Line Inc. (ODFL) and J.B. Hunt Transport Services Inc. (JBHT), as well as all the major airlines and shipping firms like United Parcel Service Inc. (UPS). So, this second MoneyShow Chart of the Day looks problematic, too.

Dow Jones Transportation Average (1-Year Chart)

The massive, post-election breakout couldn’t even hold through year-end. Then we chopped around for a couple of months...before collapsing in late February.

Unless and until we see some improvement in the semis AND the semis, you have to play more defense in your trading portfolio. And you have to be more concerned about the economic outlook.