Axis Capital Holdings Ltd. (AXS) shows strong technical buy signals, with a Trend Seeker buy signal since 3/17 and consistent price appreciation, gaining 2.7%. The company offers diverse specialty insurance and reinsurance products globally, with notable growth in revenue and earnings expected over the next two years, observes Jim Van Meerten, analyst at Barchart.

Technical indicators are highly favorable: 100% buy signals, above key moving averages, and a strong Relative Strength Index of 66.3%. Analyst sentiment is positive, with multiple strong buy ratings and a consensus price target of $108, indicating a potential 10% gain.

I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal. Then I used the Flipchart feature to review the charts for consistent price appreciation.

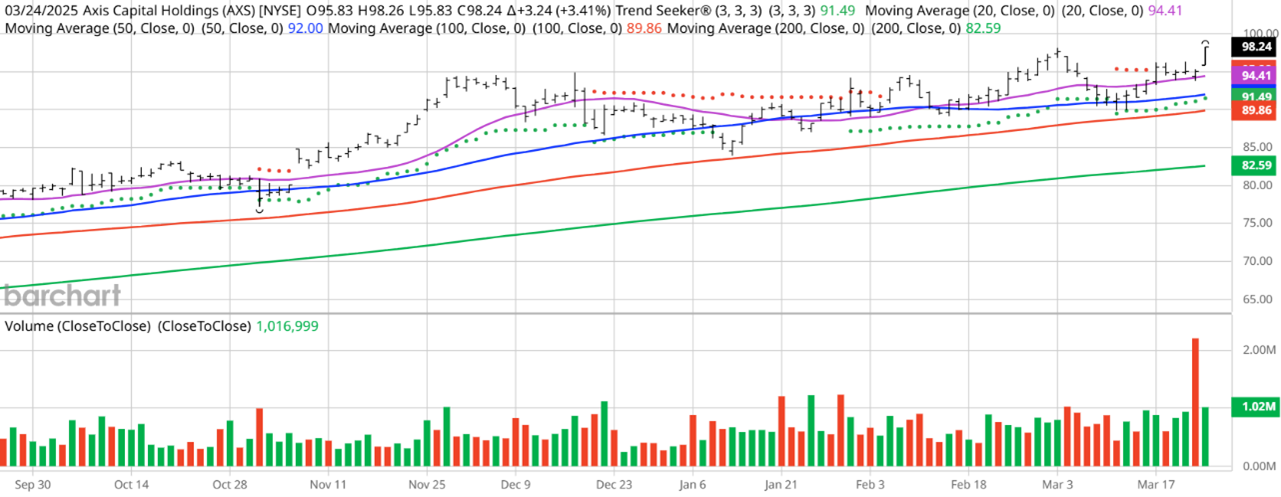

AXS Price vs. Daily Moving Averages

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates.

Barchart Technical Indicators:

- 100% technical buy signals

- 51.62+ Weighted Alpha

- 56.2% gain in the last year

- 0.91 - 60 month Beta

- Trend Seeker buy signal

- Above its 20-, 50-, and 100-day moving averages

- Five new highs and up 4.4% in the last month

- Relative Strength Index 66.3%

- Technical support level at $96.63

- Recently traded at $98.24 with 50-day moving average of $92