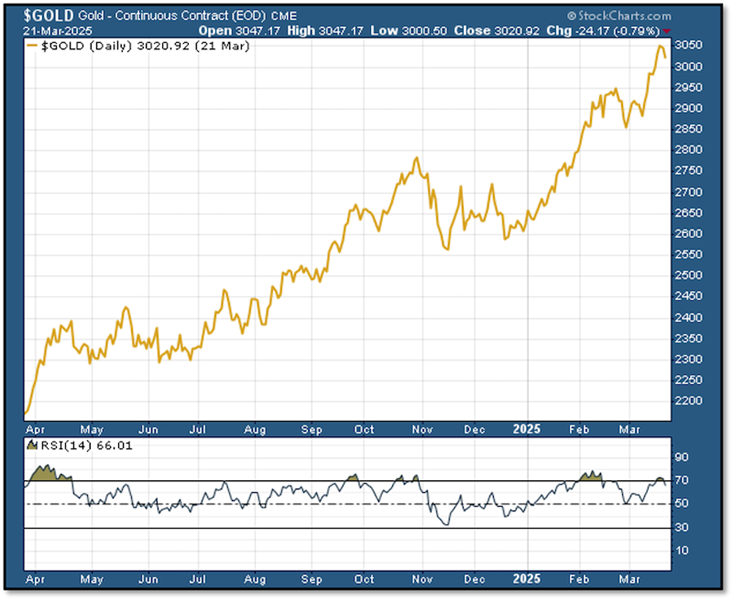

Gold just dropped more than $40 in price from last week’s high. The gold bug reaction? A collective yawn. Meanwhile, every previous instance of gold’s RSI peaking above 70 has presaged a price correction and, with the exception of the post-election correction, the pause in the rally has been brief, notes Brien Lundin, executive editor of Gold Newsletter.

I just read a fascinating piece by Taylor Burnett of the World Gold Council. He said:

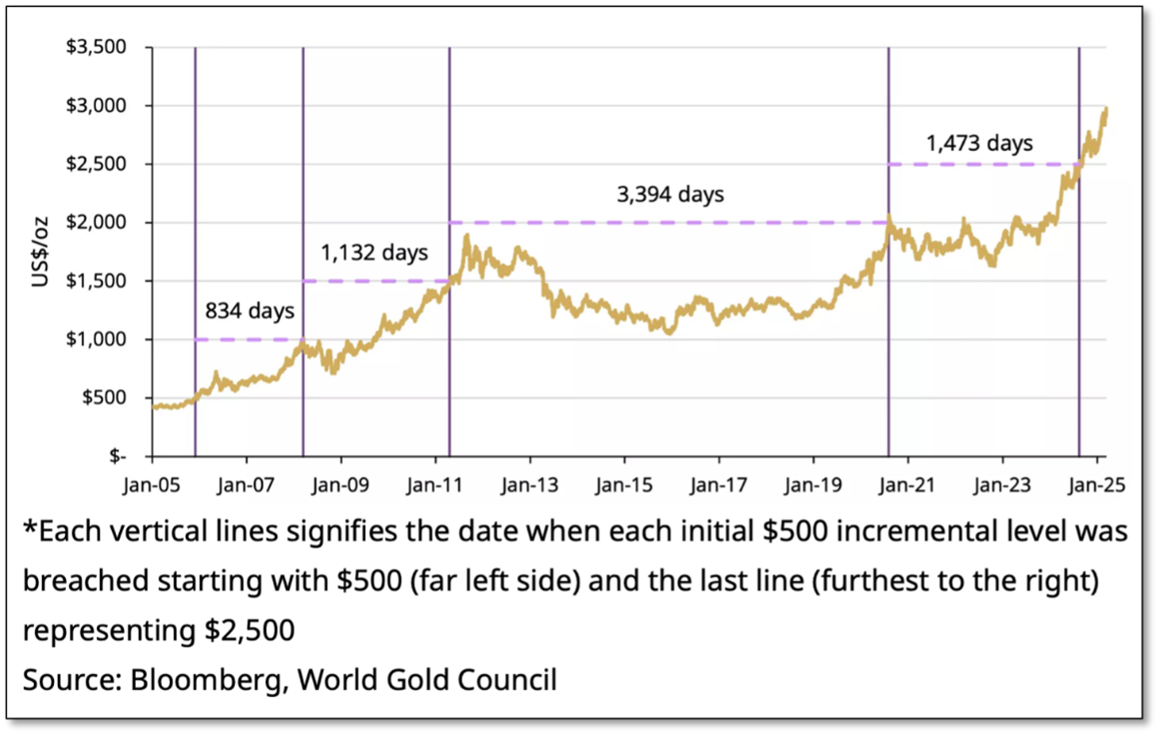

“Gold reached more than 40 new all-time highs in 2024 and 14 more so far this year…The focus isn’t just the number itself but the pace at which gold has reached it. The jump from US$2,500/oz. to US$3,000/oz. took just 210 days – a notably faster move that underscores the momentum gold has built over the past two years. Compare that to the approximate 1,700 days that gold took, on average, to achieve previous US$500/oz. increments, and the move stands out.”

So, with such a rapid rise, even accounting for relentless central bank buying and the other extraordinary factors working in favor of gold, a brief break or even a full-blown correction would not be surprising. And even welcomed.

Regardless, gold’s track record over the past year indicates that any break in the uptrend is likely to be very short. Consider this chart of gold with its RSI...which shows how brief past pauses have been.

We’ll see the extent of this rest period soon. In the meantime, the mining stocks have been leveraging gold (both to the upside and downside, however) and I’ve seen the FOMO factor at work lately in the juniors.

In short, the markets are moving, money is coming in, and news is being made. I wouldn’t wait to make sure your portfolio is properly positioned.