The road back from a market correction can be uneven, but sooner or later good stocks recover. The important factor is speed, which is why I’m pleased to see the Triple Digit Trader portfolio has already started shaking off its losses from early this month. One driver: Humble, often overlooked Ford Motor Co. (F), observes Hilary Kramer, editor of Triple Digit Trader.

Granted, there are still a few points of damage to clean up. But we’re now down “only” 3% since the end of February, while the Nasdaq and S&P 500 are still staring at 5%-6% losses over the same timeline.

As for Ford, it’s up 4% so far this month amid new initiatives from management to exploit the current globally competitive environment. It’s resonating with Wall Street at last.

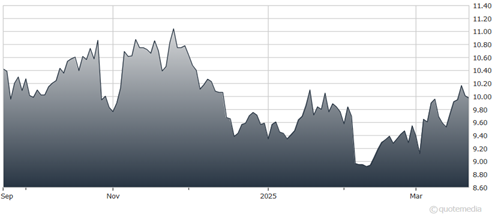

Ford Motor Co. (F)

It doesn’t take a big swing in sentiment to lift this stock. Investors can weigh the odds that F will be able to maintain its current dividend for the foreseeable future. They like what they see and are stepping up to lock in what’s now roughly a 7.5% cash yield.

Similar logic drives all of our stocks one way or another. Great companies tend to have solid management teams that make smart decisions to not only survive unsettled economic conditions but thrive. They’re profitable enough to pay shareholders back at competitive rates.

Demand for shares remains steady when other stocks suffer. I’d much rather be in F right now than Tesla Inc. (TSLA). So would a lot of people, apparently. And F may just be getting started. Remember, this was an $11 stock right after the election and traded well above $13 over the summer. That’s where we want to go.

I’m watching what could be either long-term resistance or new support at $10.22 closely. That’s the potential turning point. If F can clear that level, the calls make sense. For now, we wait and we cheer.