The stock market — never a dull moment. Here’s what is moving in both directions right now – one stock that’s hot…and one stock that’s not, says Steve Reitmeister, editor of Zen Investor.

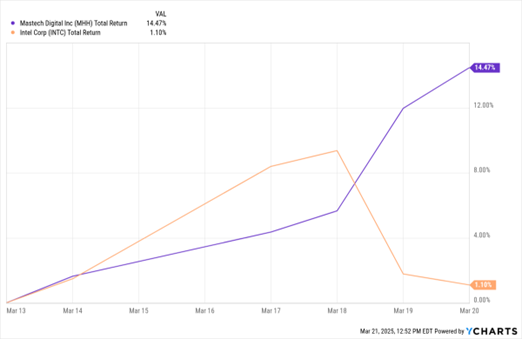

HOT: Digital transformation and IT services company Mastech Digital Inc. (MHH) gained 8.8% last Wednesday after reporting fourth-quarter earnings. The company’s data and analytics revenue increased to $36.6 million for the quarter, prompting enthusiasm from analysts who anticipate greater growth from this portion of the business than from the company’s comparatively stagnant IT staffing segment.

MHH, INTC (1-Week % Change)

Data by YCharts

Our research gives the company a B rating for Value and Financials and an A rating for Growth, making it a good bet for investors looking to add some upside potential. MHH receives a Zen Rating of A and a Strong Buy recommendation.

NOT: Intel Corp.’s (INTC) recent run-up doesn’t change our fundamental opinion of the stock. INTC gained 31% over five trading days after flirting with a deal with TSMC, but we feel that the long-term prospects for Intel remain poor. The stock lost 6.9% on Wednesday, and it’s still down more than 40% year-over-year.

Intel’s long-term momentum is poor and its financials don’t instill confidence in its stability. We’re standing our ground and maintaining our F Zen Rating and Strong Sell recommendation for INTC.