We just had another down week for the market, with the major indices probing new correction lows as recently as Thursday. That obviously keeps the intermediate-term evidence pointed down. Still, Alibaba Group Holding Ltd. (BABA) looks interesting for a trade, highlights Mike Cintolo, editor of Cabot Top Ten Trader.

The negative action is visible whether you’re looking at the trends of the major indices or the action of individual stocks. Some 70% of S&P 500 stocks and 80% of the broad market came into last Friday south of their 50-day lines. New lows are swamping new highs each day, too. Thus, right here, we’re remaining in our bunker.

As we look ahead, we could increase our exposure a bit (not a huge amount, but a notch or two on the Market Monitor) if we see the market embark on a bounce phase. We are seeing a few near-term rays of light on that front.

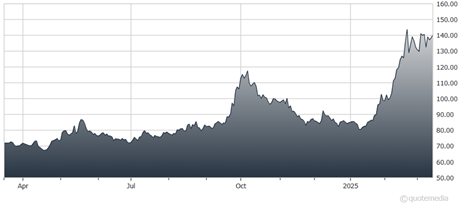

Alibaba Group Holding Ltd. (BABA)

Sentiment-wise, one of the granddaddy surveys (Investors Intelligence) is at levels usually associated with market lows (even if it’s a temporary low). For the broad market, the peak in stocks hitting new lows actually occurred Tuesday, March 4. So, we’re seeing a short-term positive divergence – a sign selling pressures are lessening a bit.

Moreover, some of the hardest-hit glamour stocks haven’t fallen further (net-net) during the past two-plus weeks. We’ll have to see how it goes. If we can get off our knees, it could provide some near-term opportunities. More importantly, it should allow for some of the market’s wheat (future leadership) to separate from the chaff.

Good stocks can go bad in a hurry in weak markets. But so far, BABA is consolidating very nicely after its huge January-February advance. If you don’t own any, we’re okay with a small buy here and a stop near $115.

Recommended Action: Buy BABA.