The selling in US growth stocks and funds like the Technology Select Sector SPDR ETF (XLK) continues. Meanwhile, the relative strength in funds like the iShares MSCI Japan ETF (EWJ) looks interesting, writes JC Parets, founder of AllStarCharts.

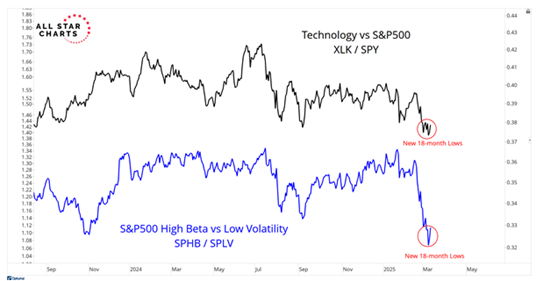

While the selling pressure in growth stocks has accelerated recently, the underperformance has been there since last summer. We've been pointing out that High Beta never broke out relative to Low Volatility stocks while the major indices were making new highs. And now they're making new lows.

Look at the underperformance from XLK along with the underperformance in High Beta, represented by the Invesco S&P 500 High Beta ETF (SPHB).

I'll be the first to tell you that it affects me, too. Remember that on a personal level, my wife and I have retirement accounts and we have three kids with college funds. I'm not immune to the selling in US Growth stocks. I'm right in there with you guys, regardless of what I do for my day job.

But this is a great example of why we don't want to limit ourselves to a long-only strategy in US stocks. I've already got plenty of that stuff. Too much, if you ask me. So, I need to go out of my way to find additional sources of income and returns.

That's why I’m striving to find areas in the market that are working. And it's not just Chinese and European stocks. The relative strength in Japan also looks interesting. The EWJ ETF plays Japan priced in US Dollars. So, the ETF does better in a weaker-dollar tape: