When investors look for long-term bullish S&P 500 signals, they look at the US CPI, interest rates, and M2 supply (relatively liquid assets in the US economy). This is a mistake. If you’re trading the S&P, you can’t just focus on US liquidity. You need to focus on global liquidity instead, observes Gav Blaxberg, CEO of Wolf Financial.

Unlike most countries, the US stock market is global. German citizens rarely invest in Japanese stocks. But many will invest in Nvidia Corp. (NVDA), Apple Inc. (AAPL), Microsoft Corp. (MSFT), and so on.

When central banks print money, it enters the economy of that respective country. A portion of that money goes to citizens who buy food, shelter, clothing, etc. However, some of them will invest their cash into assets. A sizable portion specifically goes into the S&P or S&P-included companies.

The problem is that global liquidity is hard to measure. Combining M2 and interest rate data from the world’s central banks isn’t easy. That’s why financial data platforms like Ycharts and TradingView don’t have a global liquidity metric.

This is why investors typically track liquidity from the five biggest central banks. They are the Bank of Japan, Federal Reserve, Bank of England, European Central Bank, and People’s Bank of China.

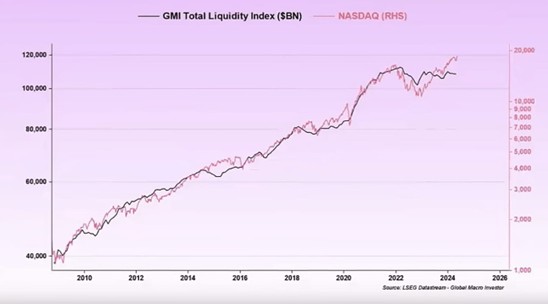

Thanks to the US stock market's global status, global liquidity is highly correlated. Popular US stock indexes like the Nasdaq, for example, have a 95% correlation. The S&P has an 85% correlation, approximately. This chart here speaks volumes.

It’s important to remember that there’s a delay between global liquidity and the stock market. It takes time for liquidity to flow into assets and inflate prices. The process is: Liquidity, stocks, fewer shares, lower supply, prices rise.

What’s the moral of the story? Don’t just analyze US monetary policies. Monitor the policies of the biggest central banks in the world. With a delay, you can reliably predict the movements of major US indexes.