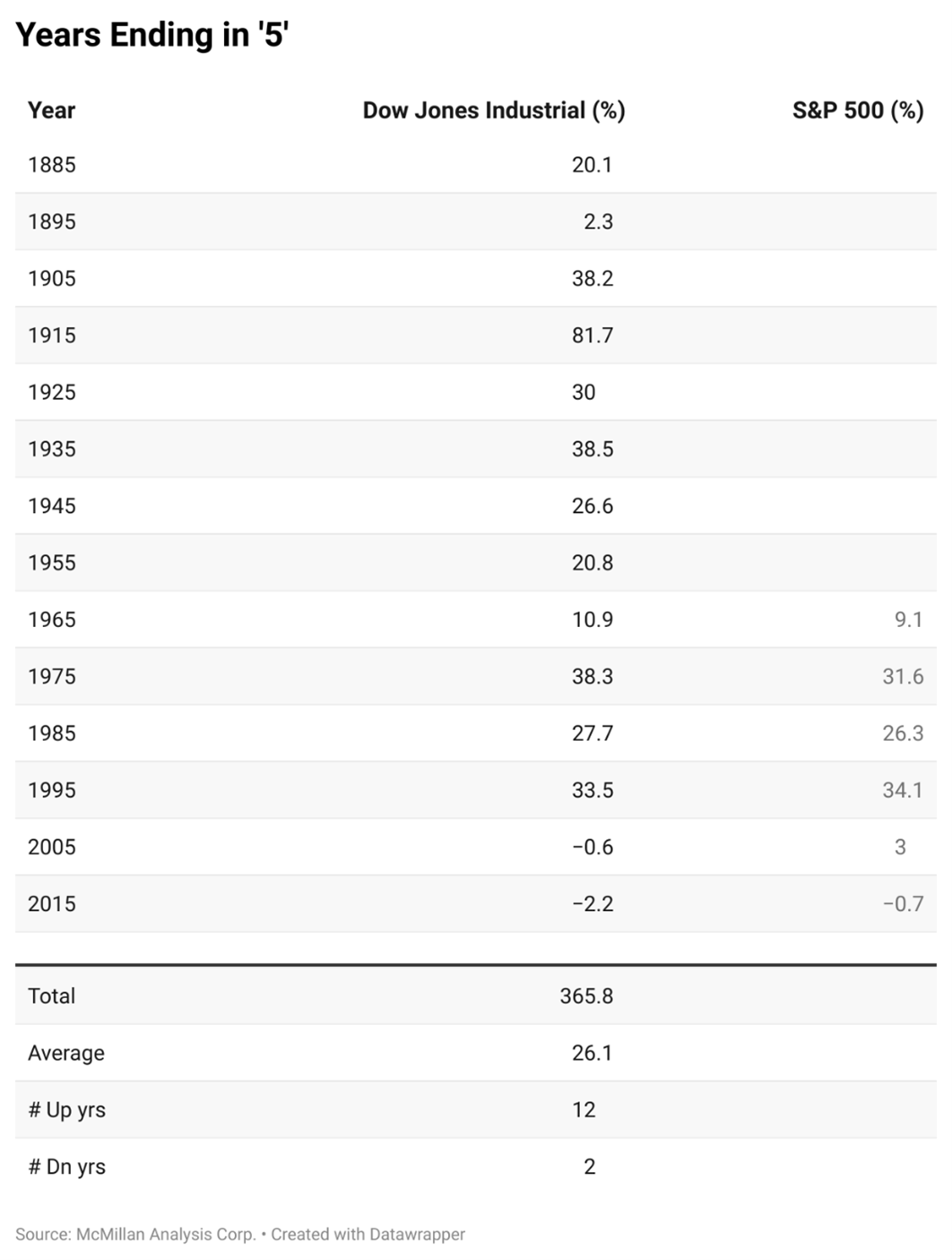

There are some longer-term seasonal patterns that affect the stock market. One is that years ending in “5” have generally been quite bullish since the first one in 1895 (to go back that far, one must observe the Dow, for SPX did not exist), advises Lawrence McMillan, editor at Option Strategist.

In fact, such years were mostly wildly bullish until 2005, when SPX registered only a small gain (and the Dow registered a small loss). Even worse, in 2015, both registered small losses. However, overall, years ending in “5” have a strong track record.

Another thing that is often watched is what is called the Four-Year Presidential Cycle. In general, the market rises modestly in the first year after a Presidential election, but in the second year, trouble arises for the stock market.

Then, in years three and four, the market rallies again as the administration in power attempts to boost the economy to get himself re-elected (or lay the groundwork for his preferred successor).