Look around. Tell me it's not a bull market. But in addition to the obvious, we also have actual proof and data to back up that statement, writes JC Parets, founder of AllStarCharts.

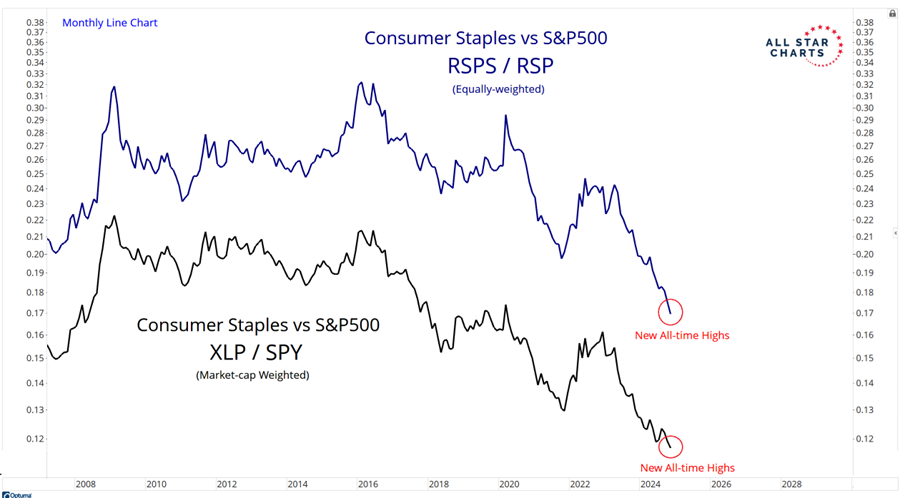

This is one of the most important charts on the planet right now. We're looking at Consumer Staples relative to the S&P500, on both a market-cap weighted and equally-weighted basis. Both of these just hit new all-time lows:

When it's a healthy market environment, where investors are being rewarded for owning stocks, these lines go down. When stocks are under pressure and investors are being rewarded for selling stocks and having excess cash, these lines go up. So, if you're one of these people who think some crisis is coming soon...and you have a bad feeling about the market...and you're in the recession camp, or whatever excuse you've made up to justify fighting trends, this chart above should be front and center. Bottom line: If these lines in the chart above are going down, then your crisis is still just a made-up thing in your head that doesn't exist. Like the tooth fairy or the easter bunny.

Meanwhile, another common myth out there among the sad little bears is that small-caps underperforming means some kind of impending doom. But the small-cap indexes have been outperforming since the summer. Both the Russell 2000 Small-cap Index and the S&P 600 Small-cap Index made new all-time highs this week. And when it comes to the momentum factor, the performance is even better. Look at the Small-cap Momentum Index fund breaking out of this multi-year base to new all-time highs.

Look at the top holdings: Industrials, Financials, and Consumer Discretionary. Are those risk-off sectors? No. This is RISK-ON behavior. And to bet otherwise is historically a very bad decision. We're embracing the rotation and market strength.